S U M M A R Y

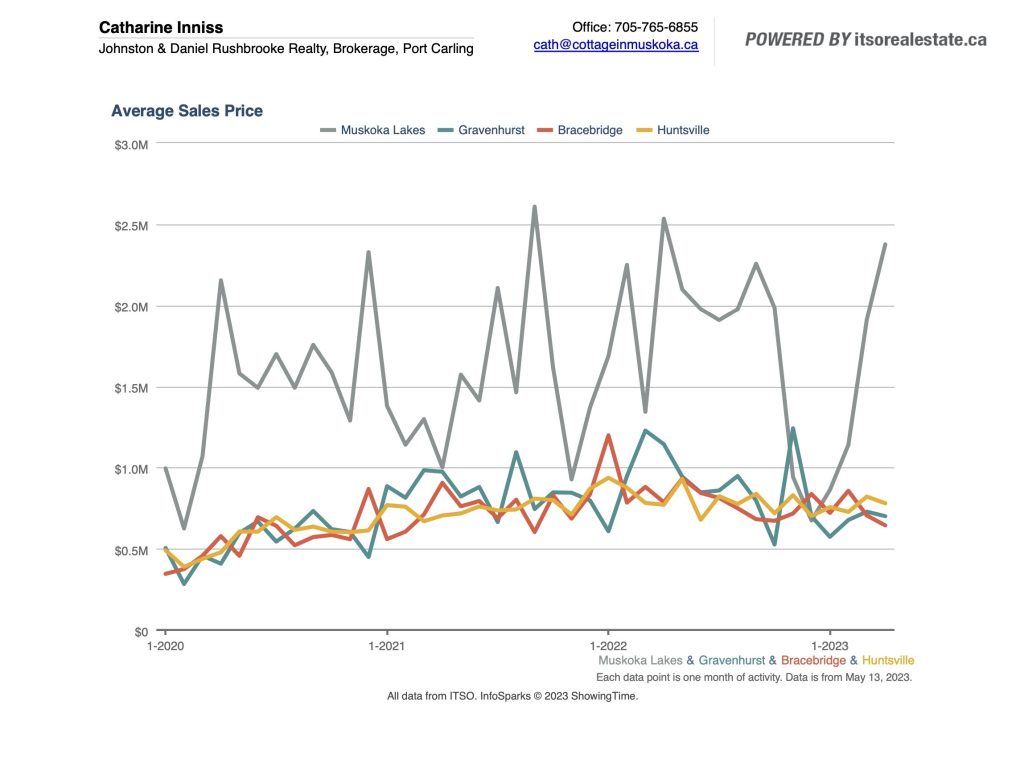

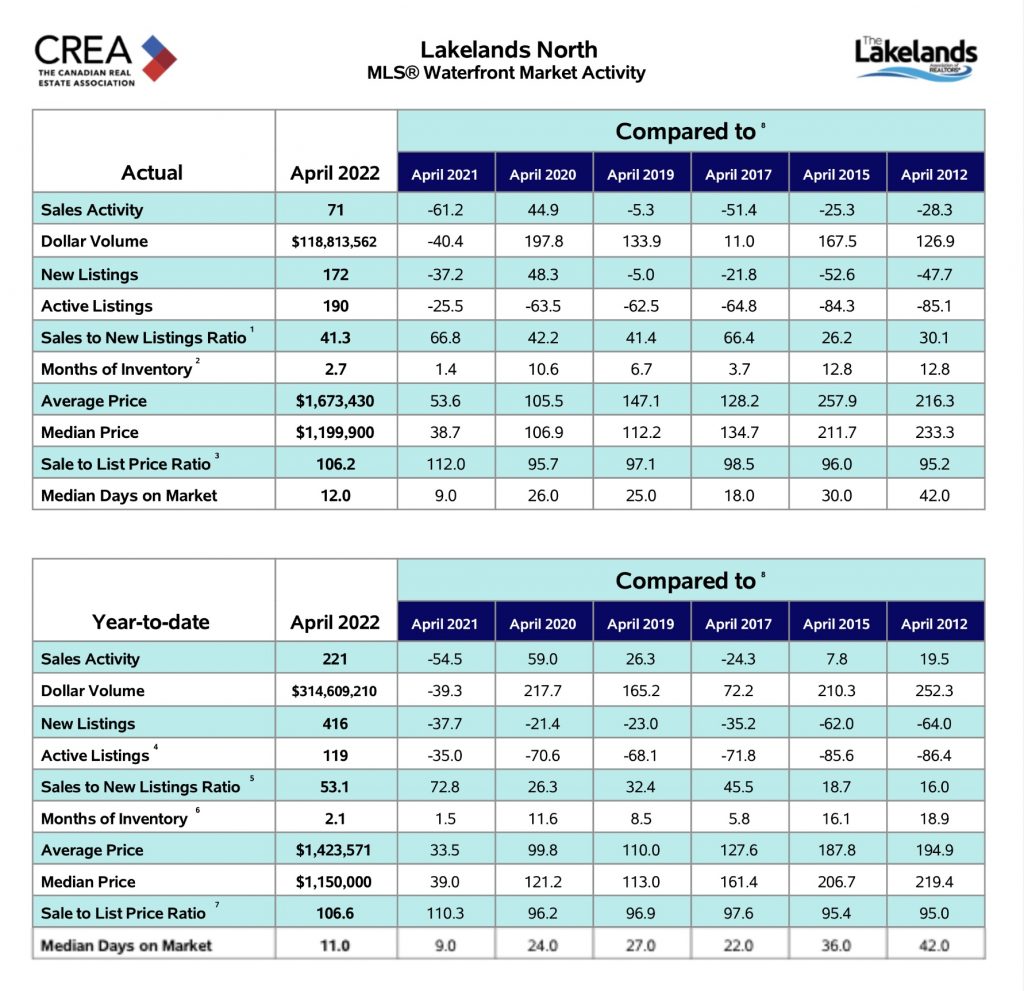

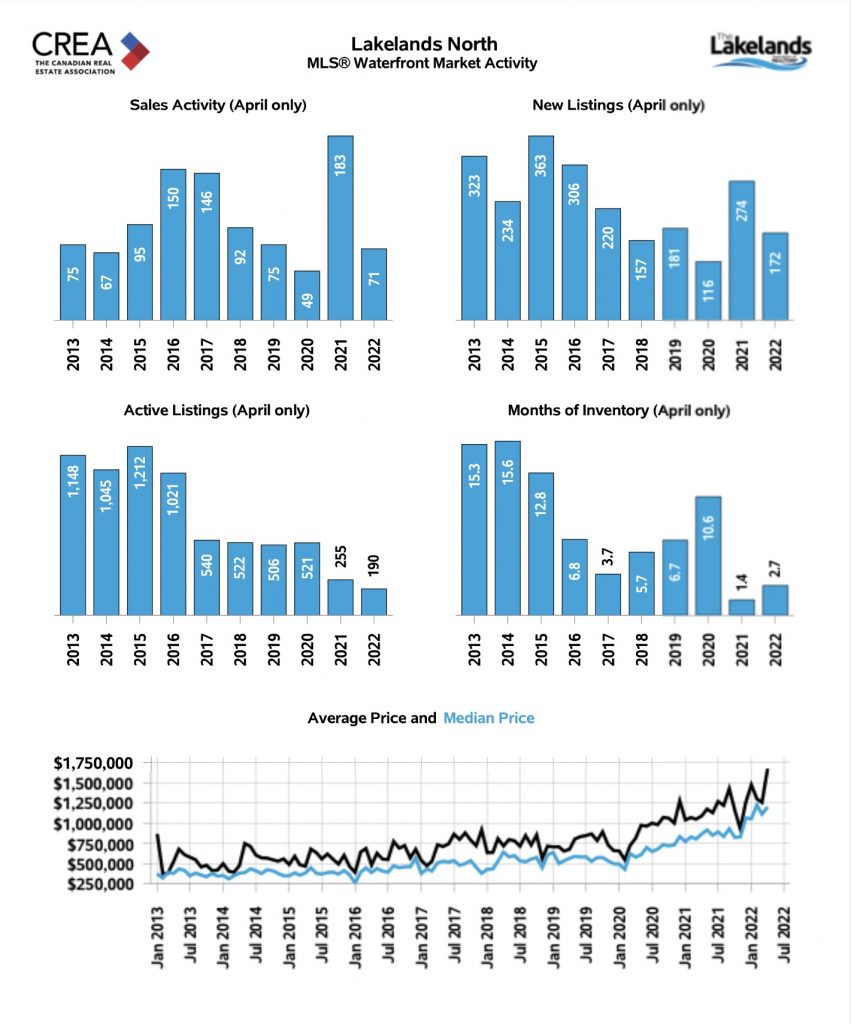

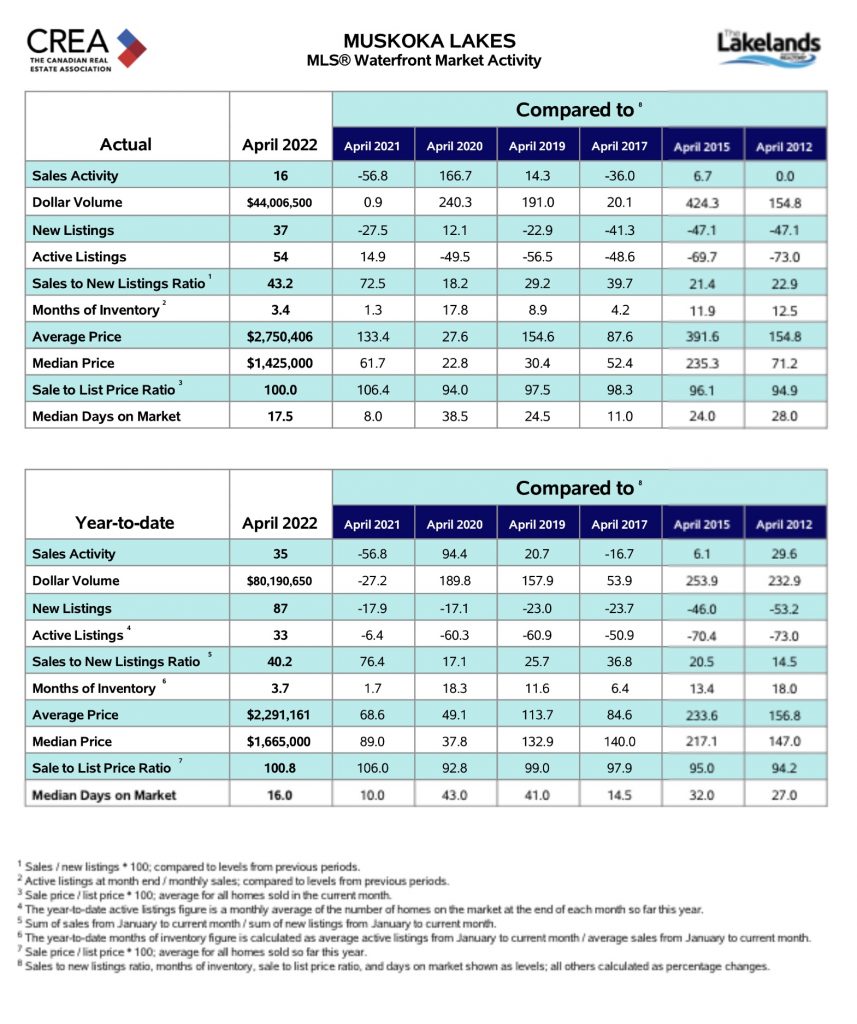

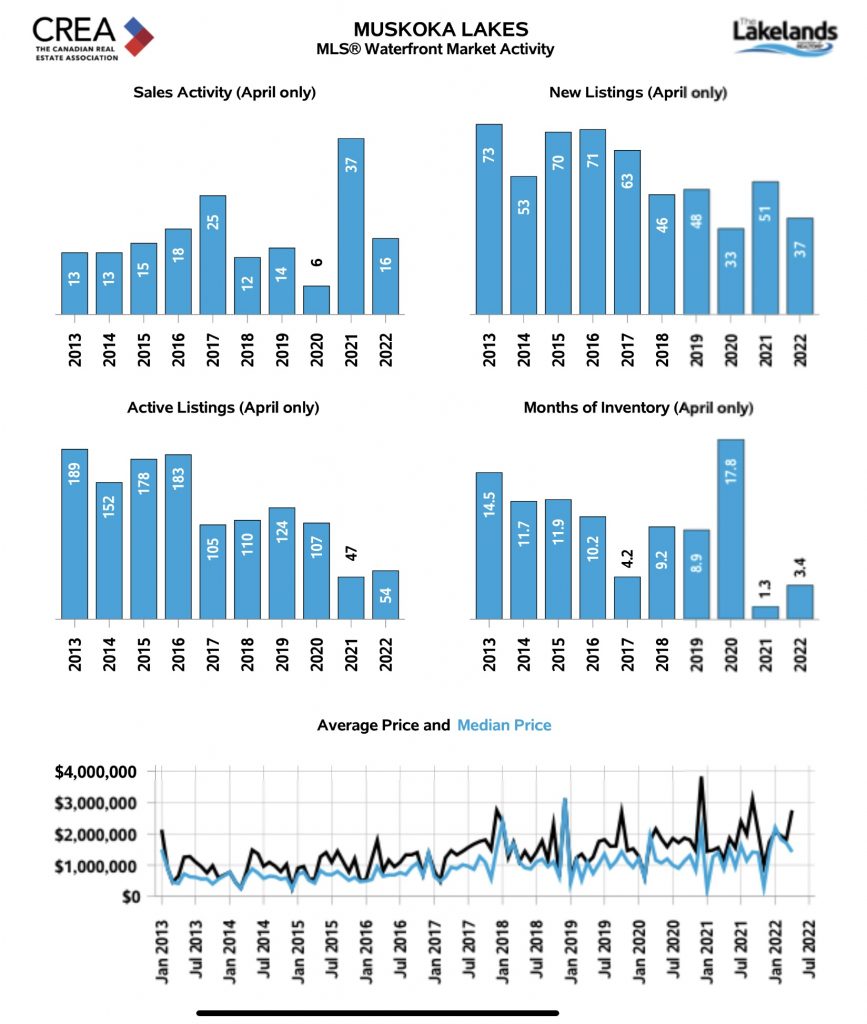

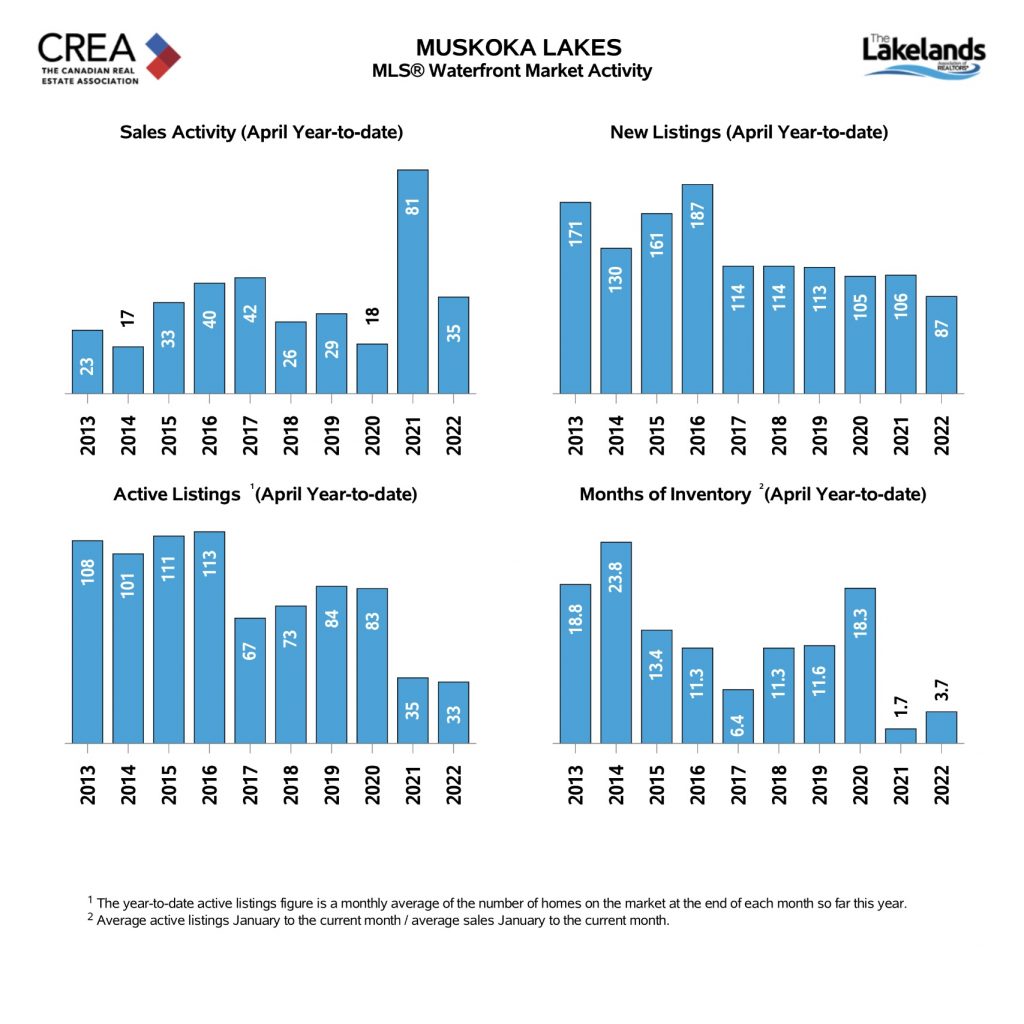

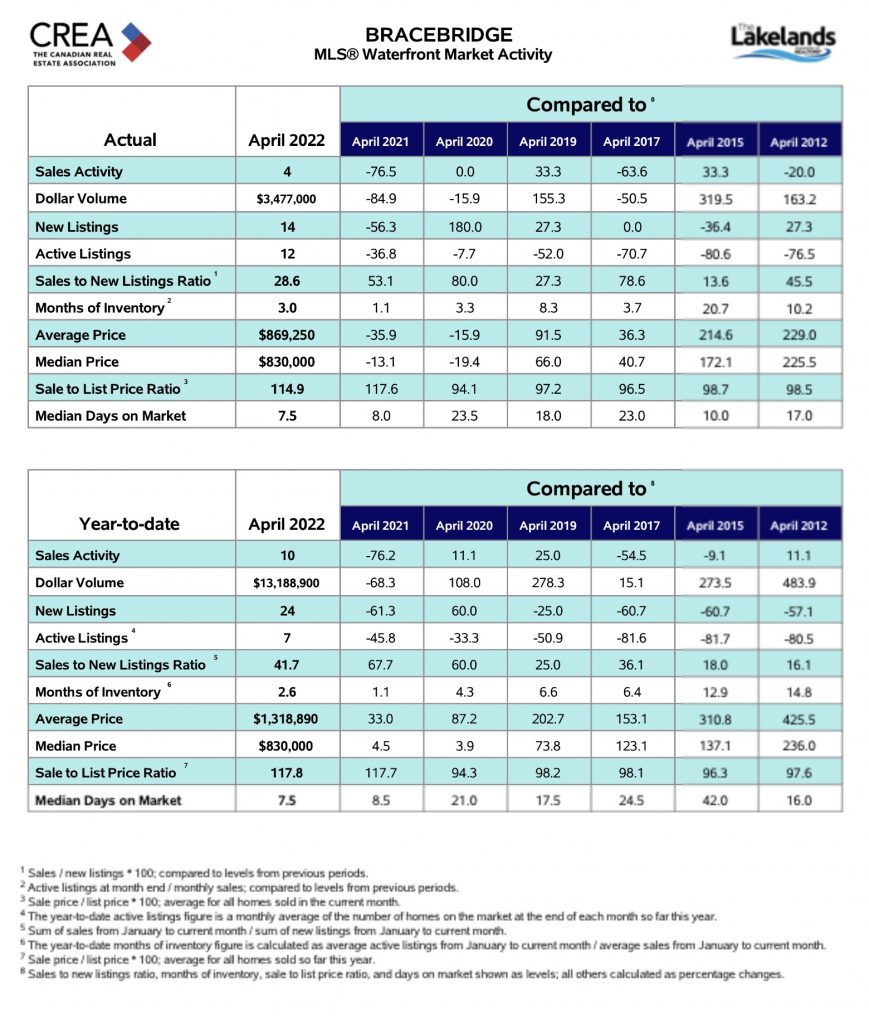

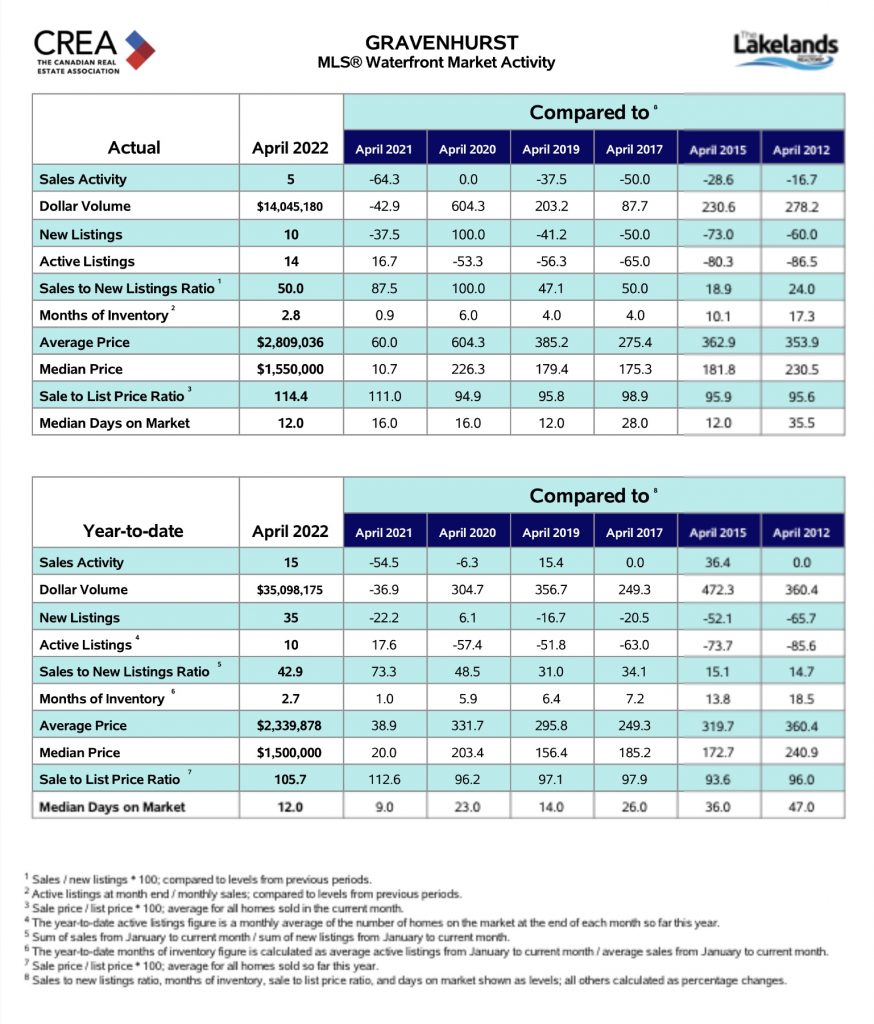

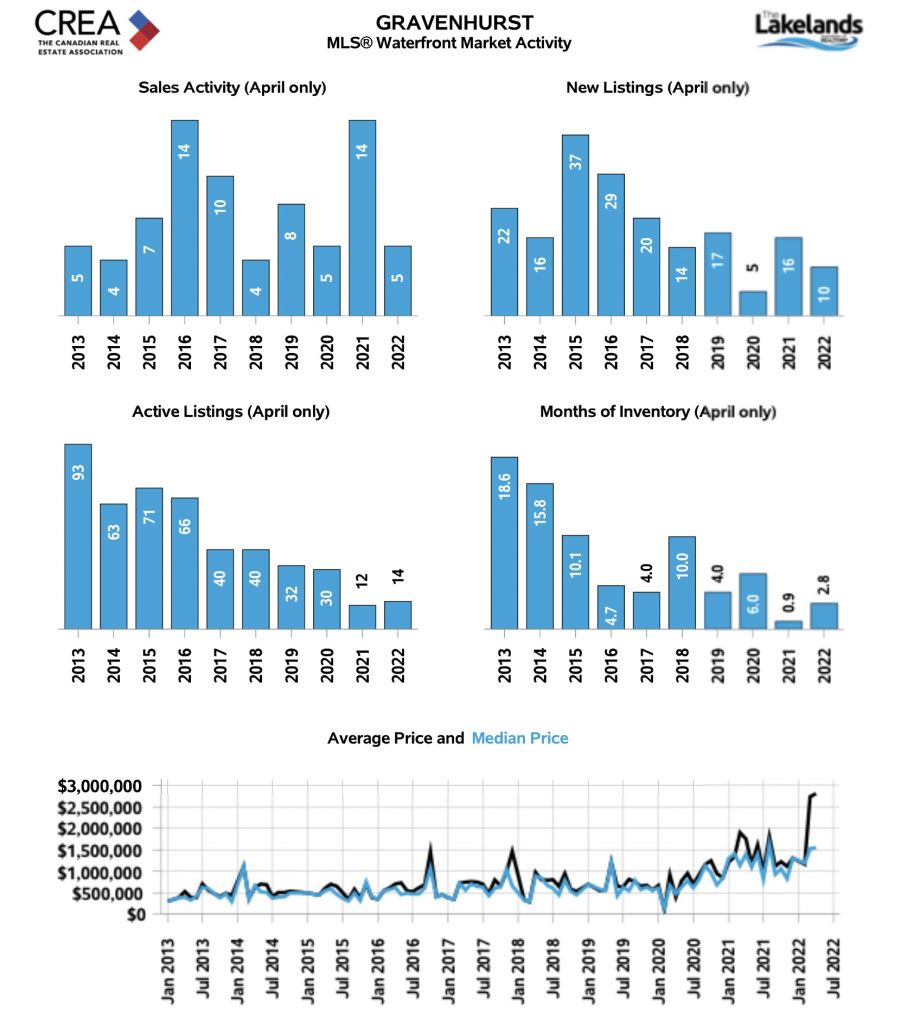

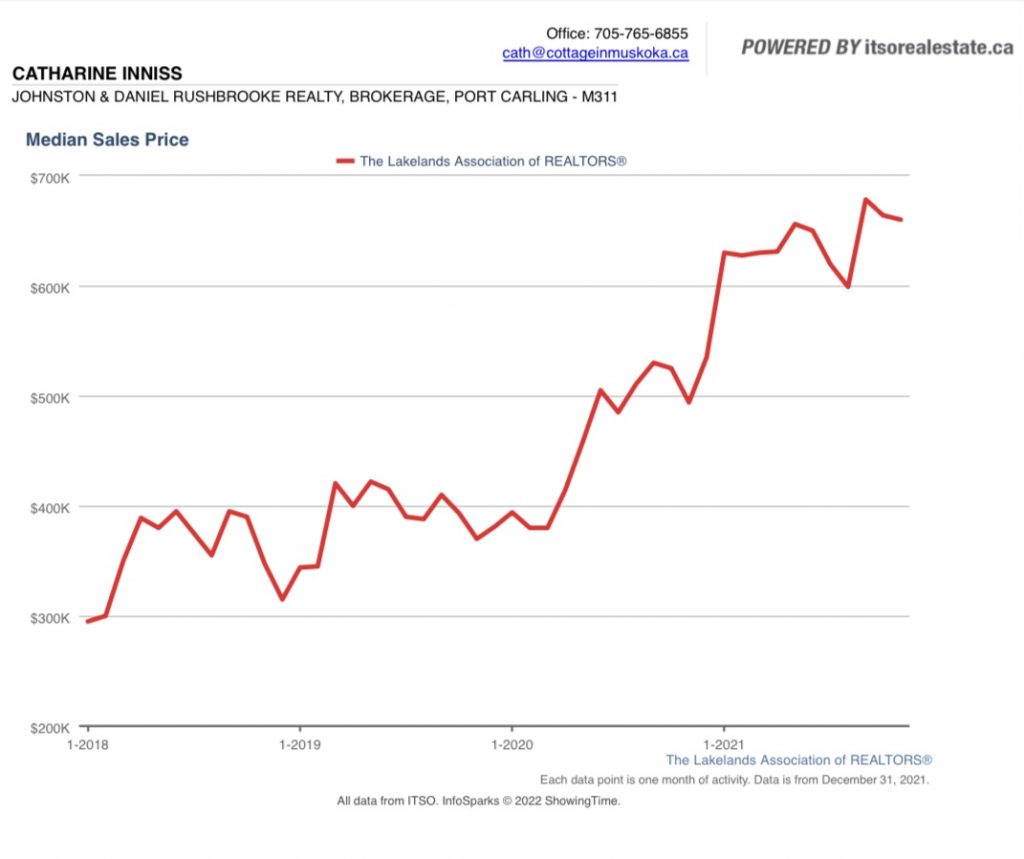

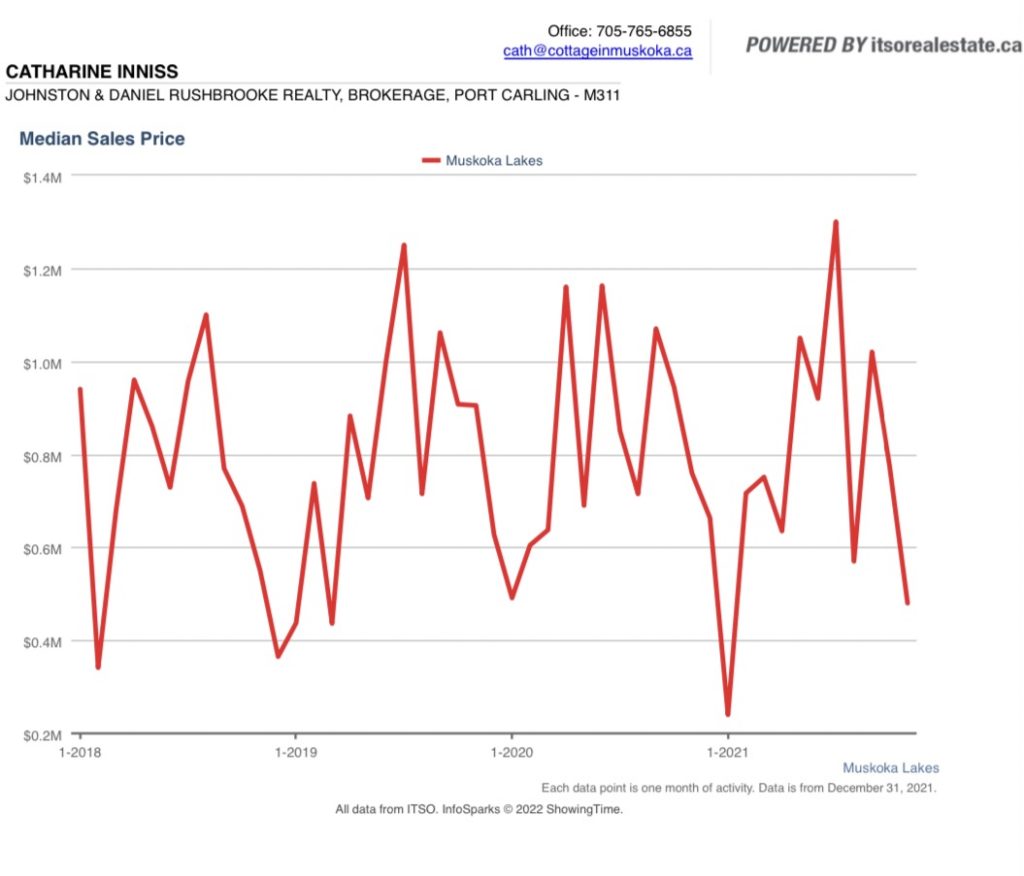

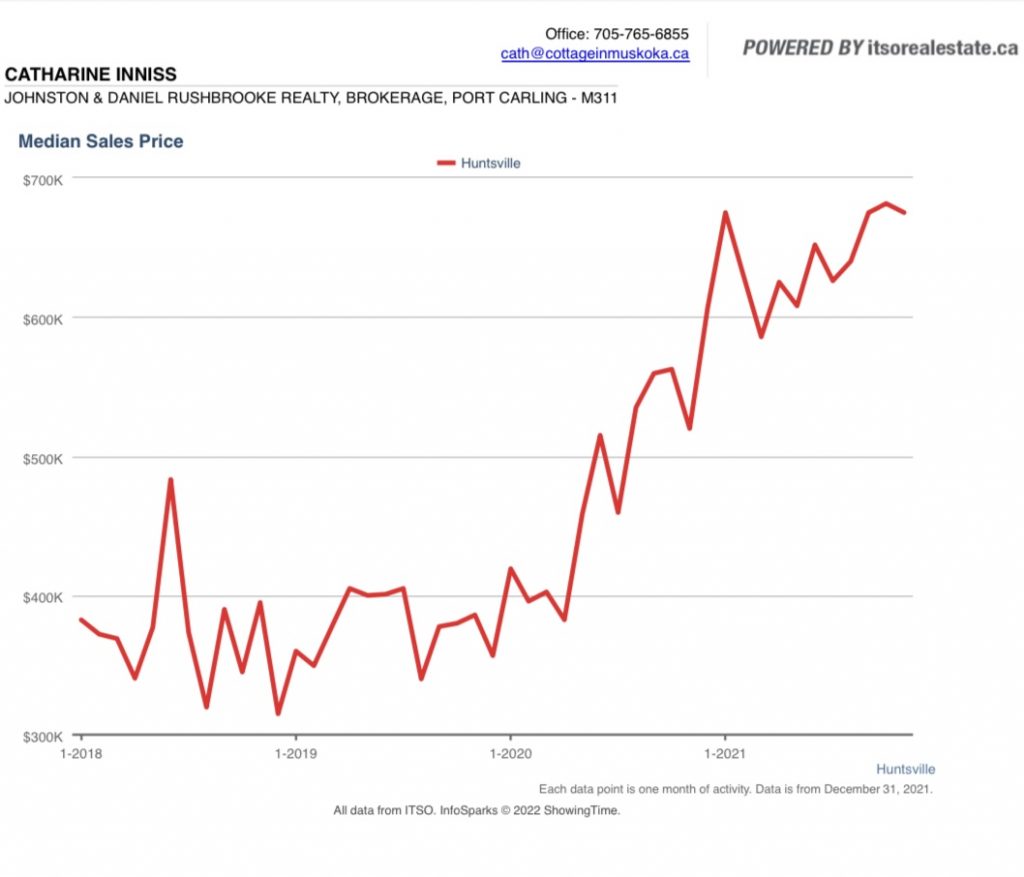

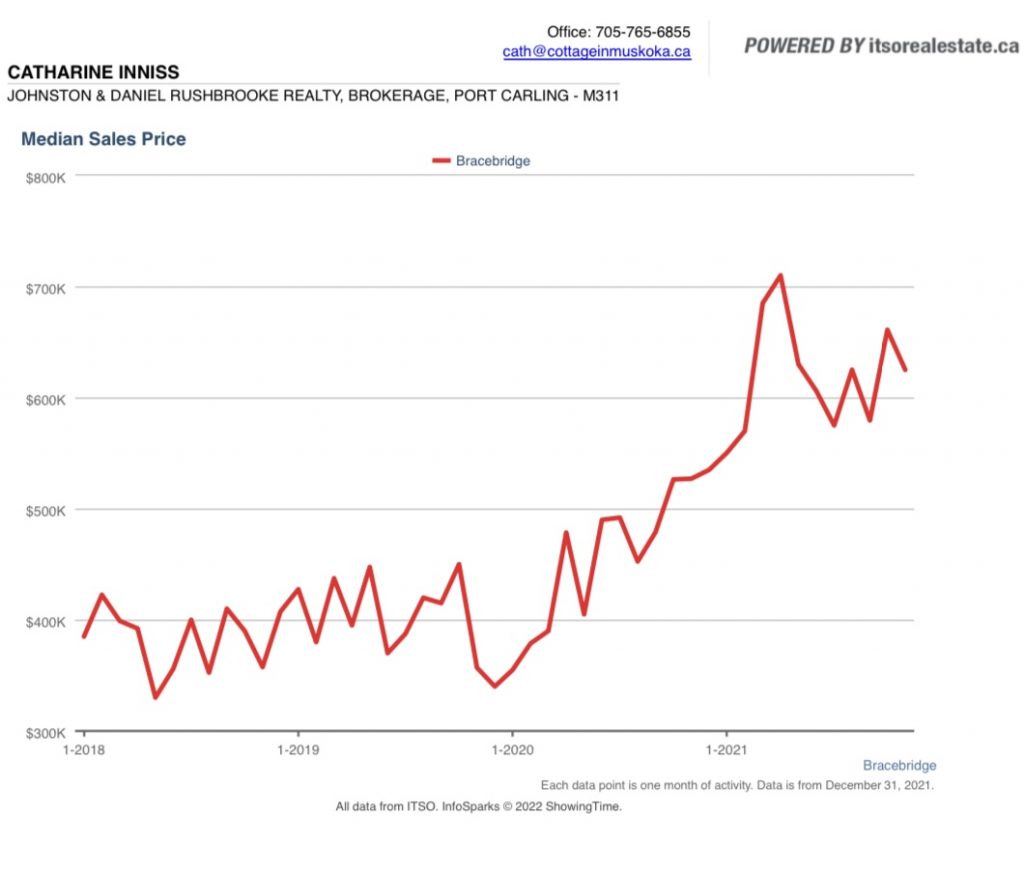

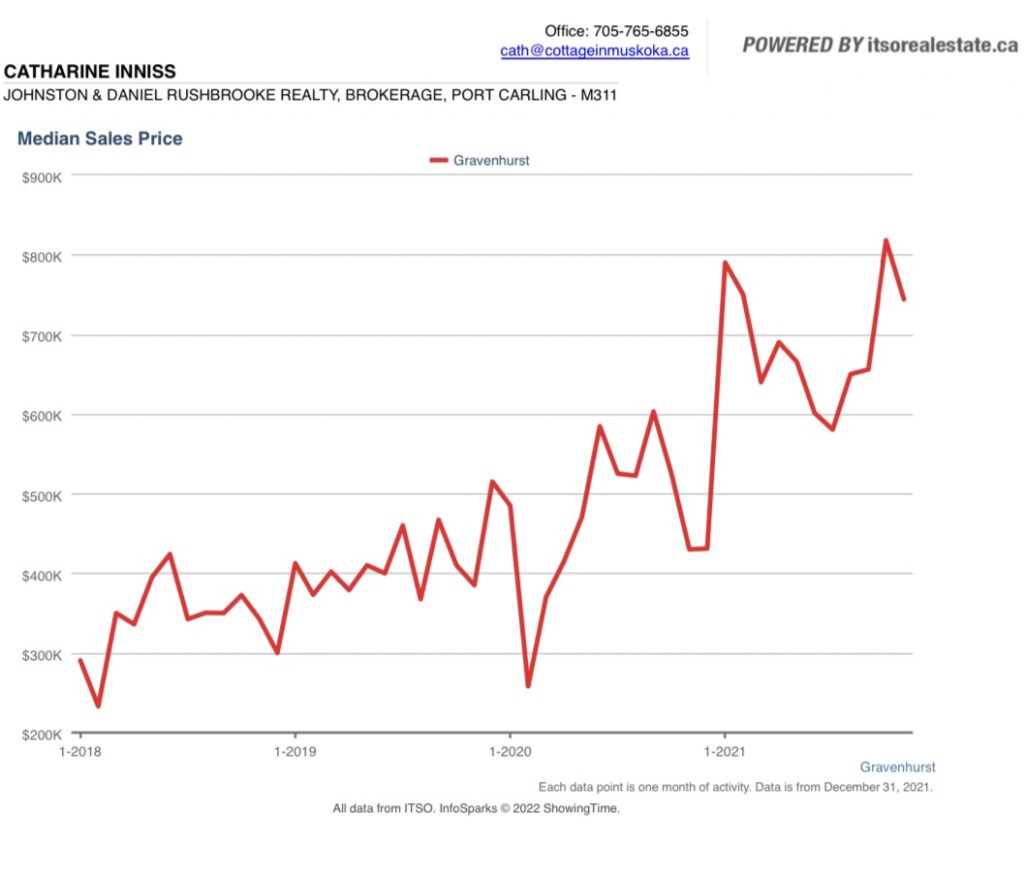

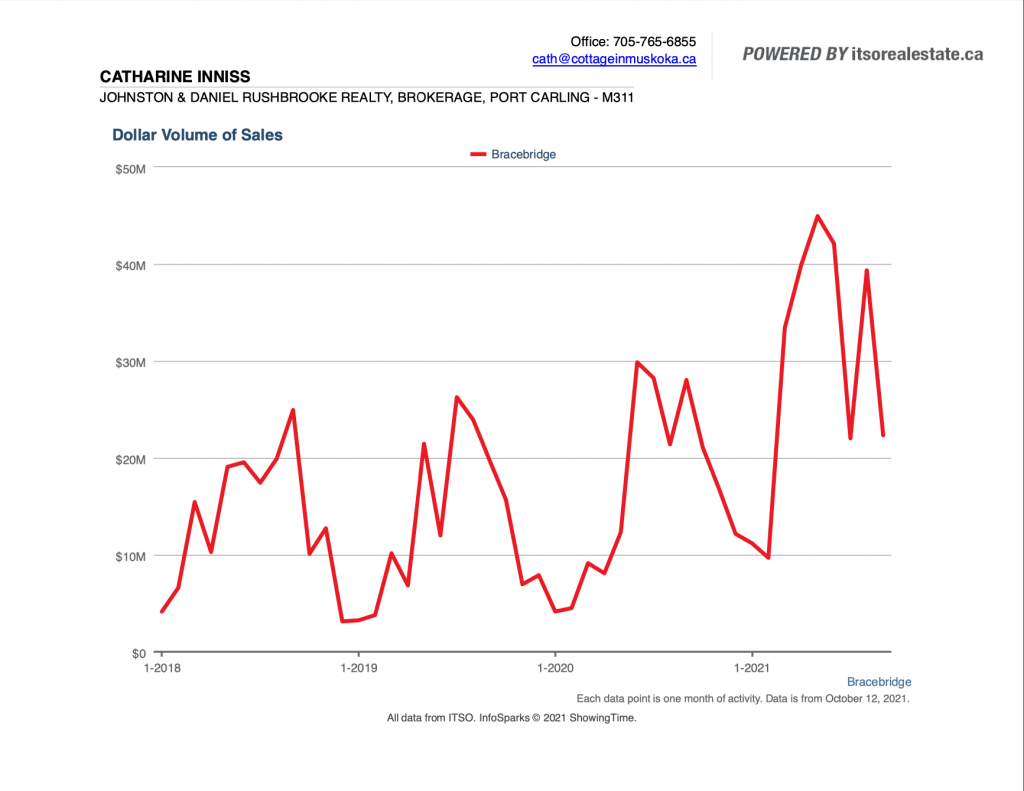

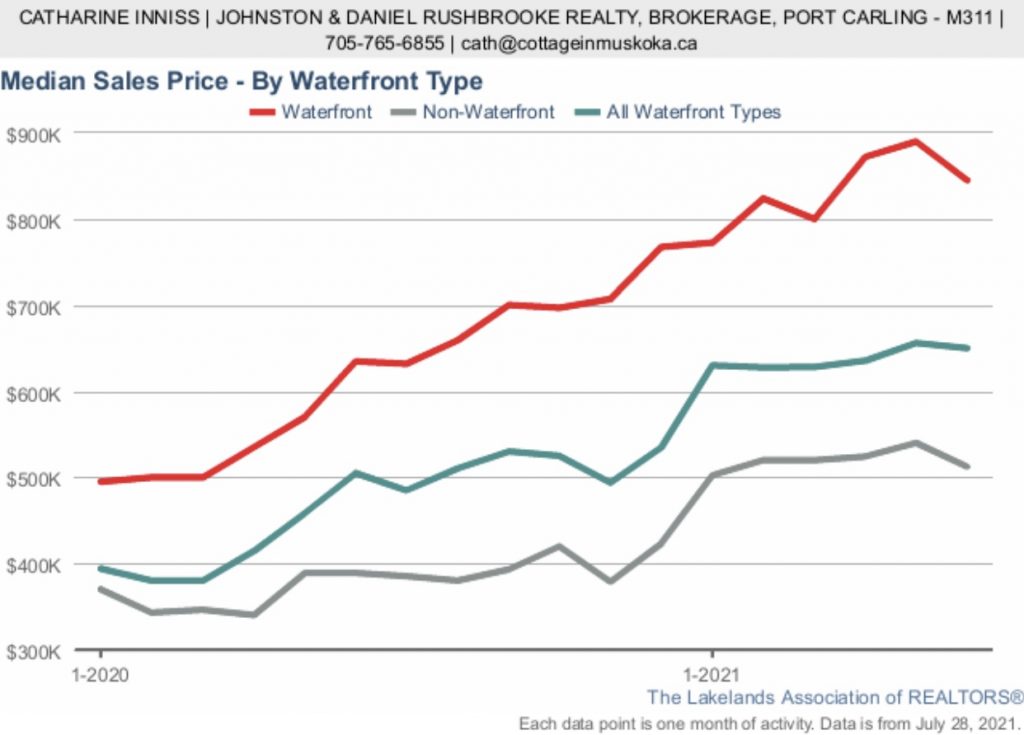

Despite matching the lowest activity in over 20 years, the massive, media-predicted price reductions never came to pass in 2023 for the Muskoka recreational market. On the surface, the sales data suggest that prices increased by roughly 10% from 2022 to 2023. However, activity at the highest end of the market skewed these numbers and illustrate why “average price” is often more instructive to where the sales are occurring, in this case, in the high-end of the market, rather than providing a general statement on the entirety of a market.

We saw, an additional seven properties, with an average price of $12,000,000 sell in 2023. These sales alone increased the average price by over $200,000 and further reminds us of the limitations of benchmarking a fragmented and relatively small market such as Muskoka waterfront. Normalizing for these extremes, the numbers indicate that prices fell by high single digits – well off the 30% figure cited in the headlines. The fire sale that many buyers were waiting for never occurred and sellers looking to ride the pandemic market wave were met with growing inventory and tentative buyers. The market entered firmly into a more balanced “give-and-take” between sellers and buyers.

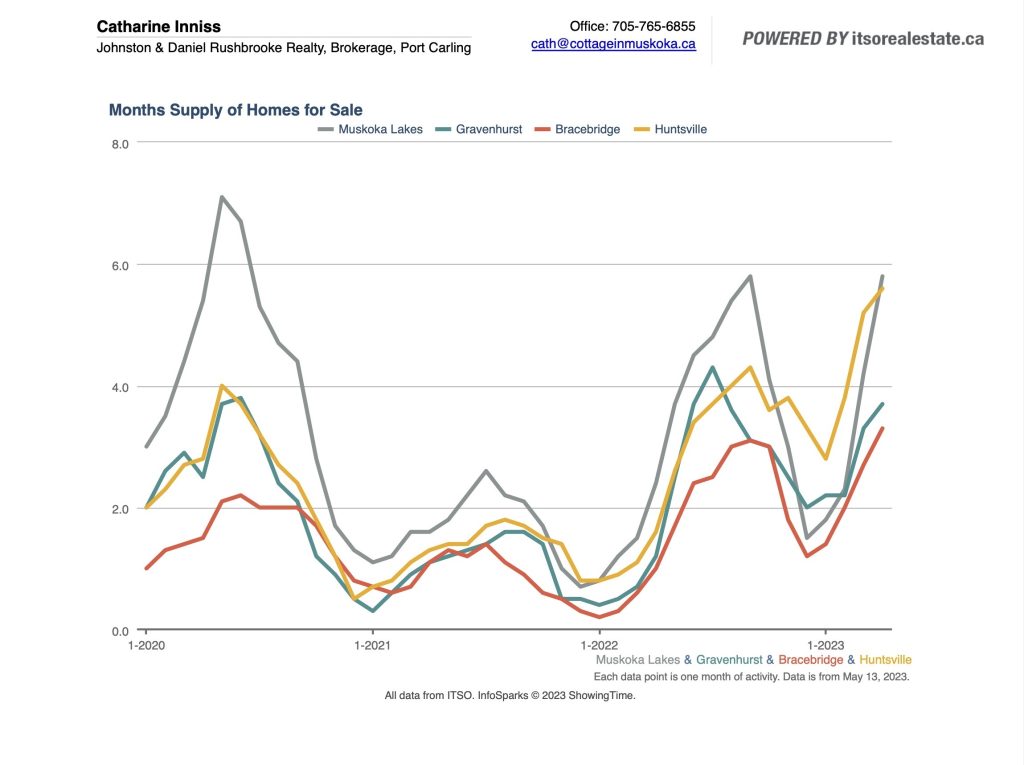

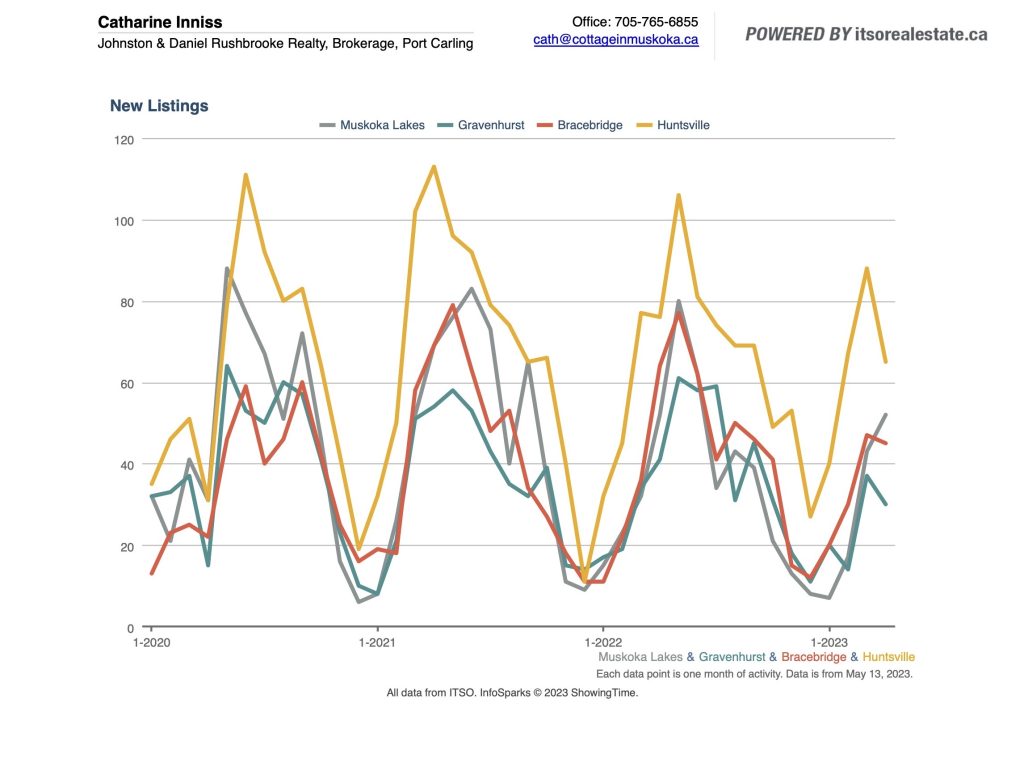

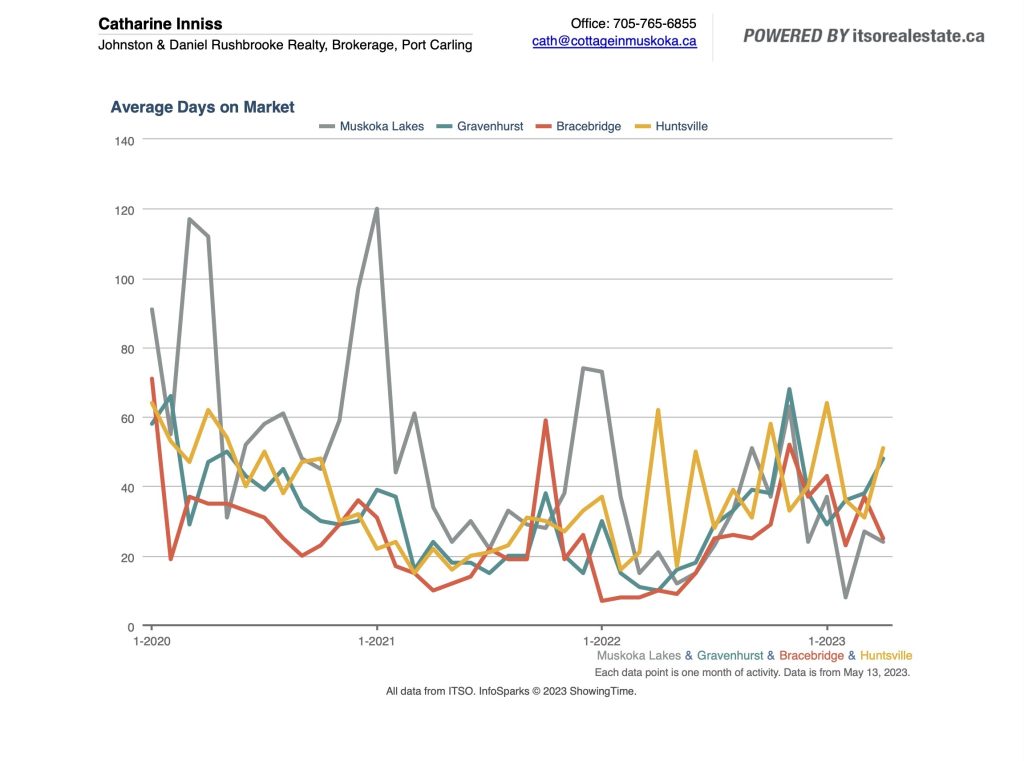

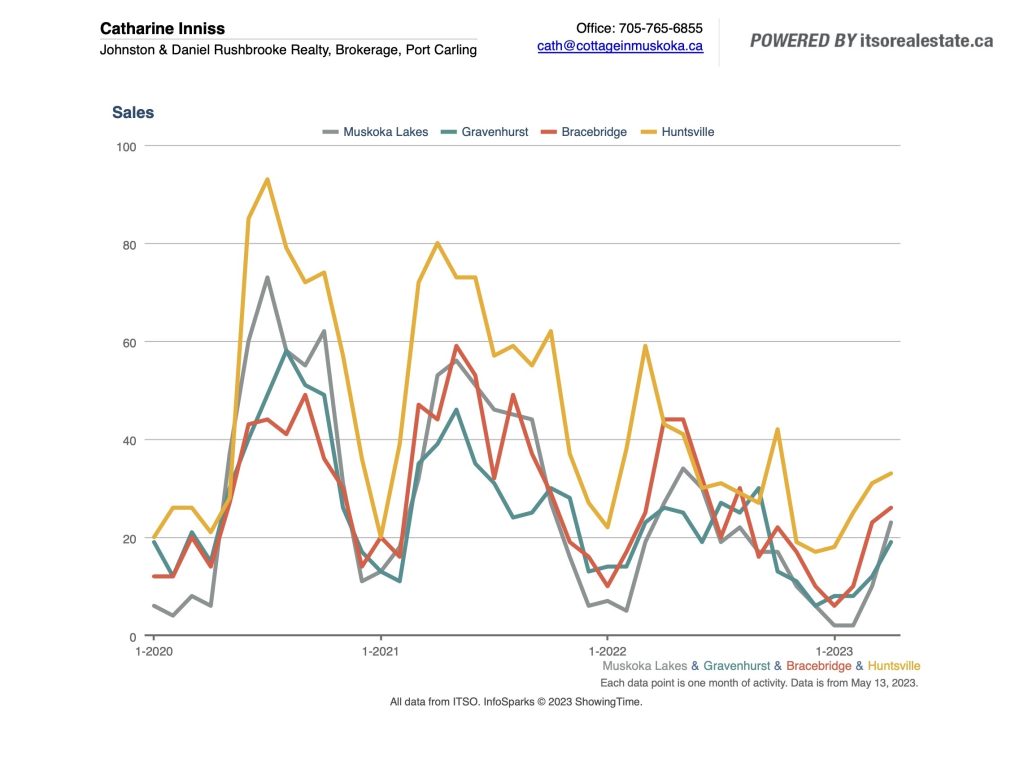

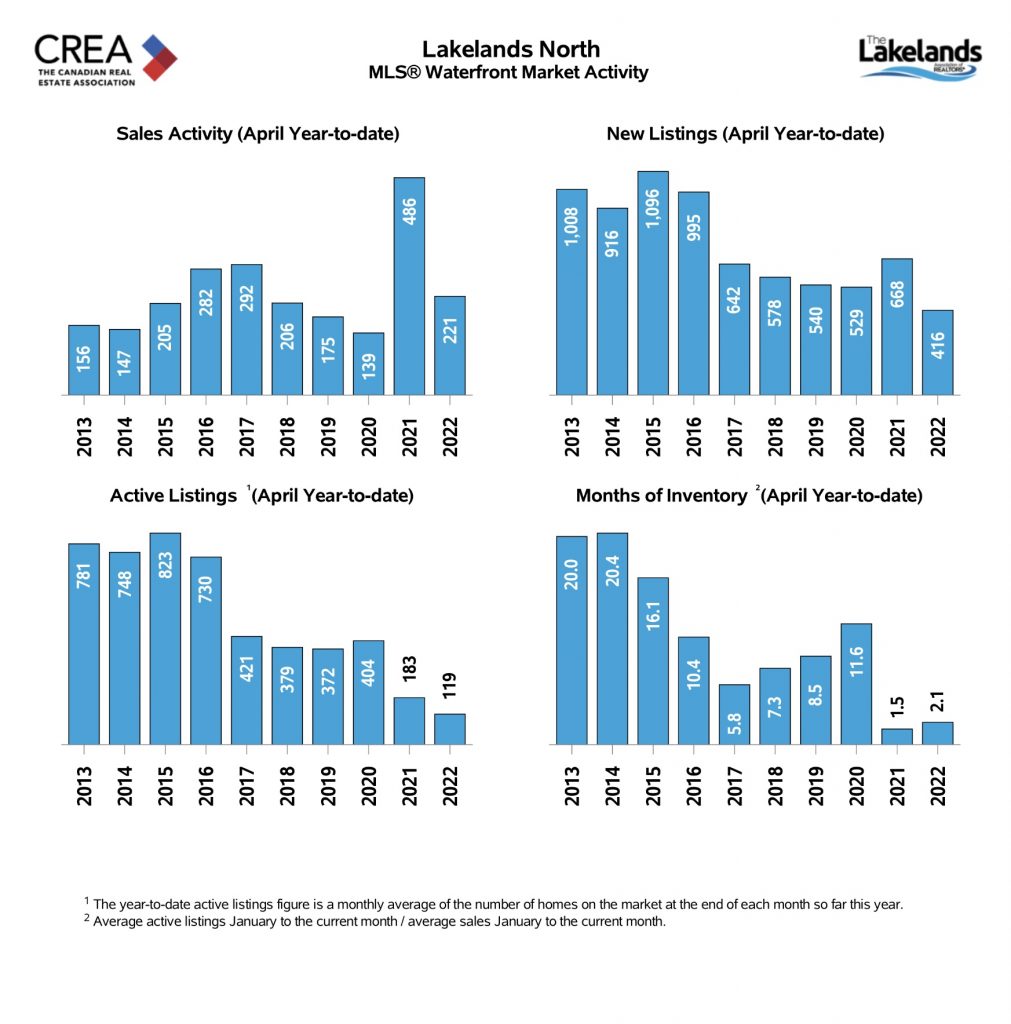

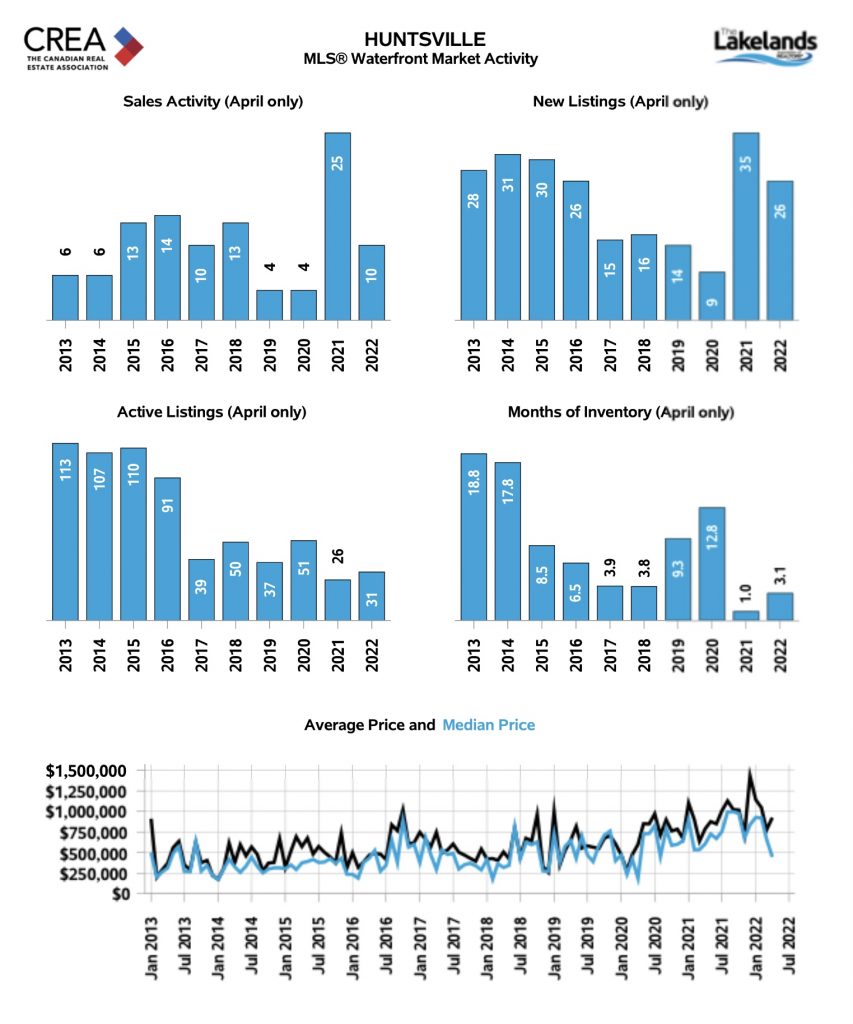

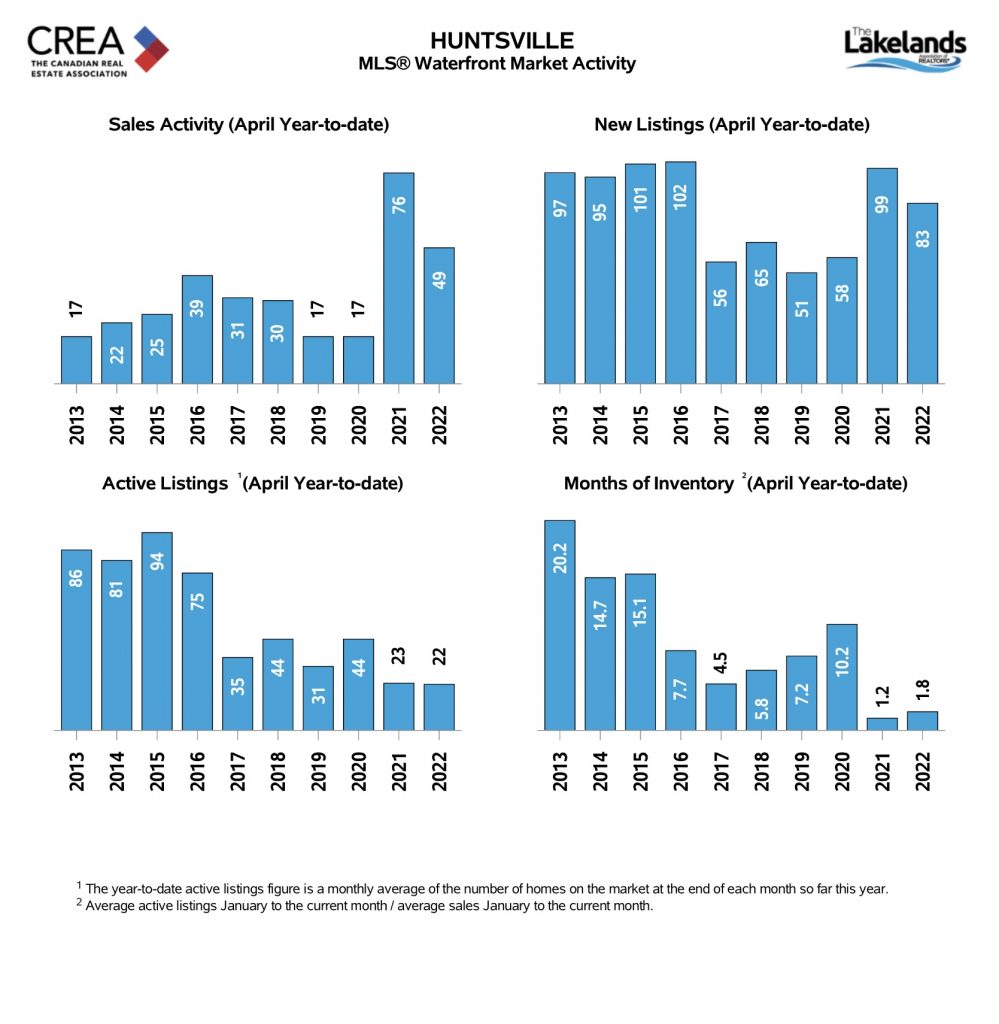

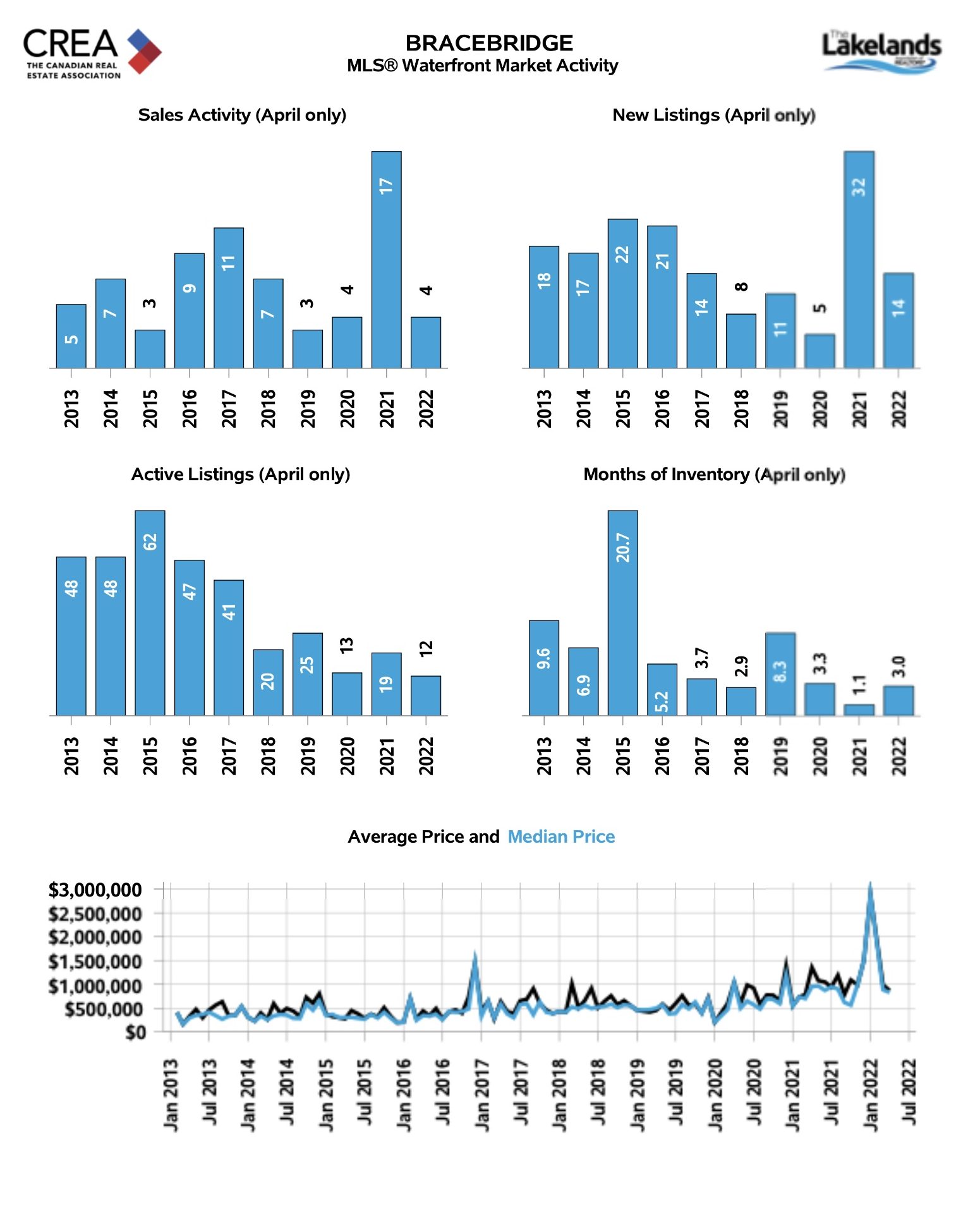

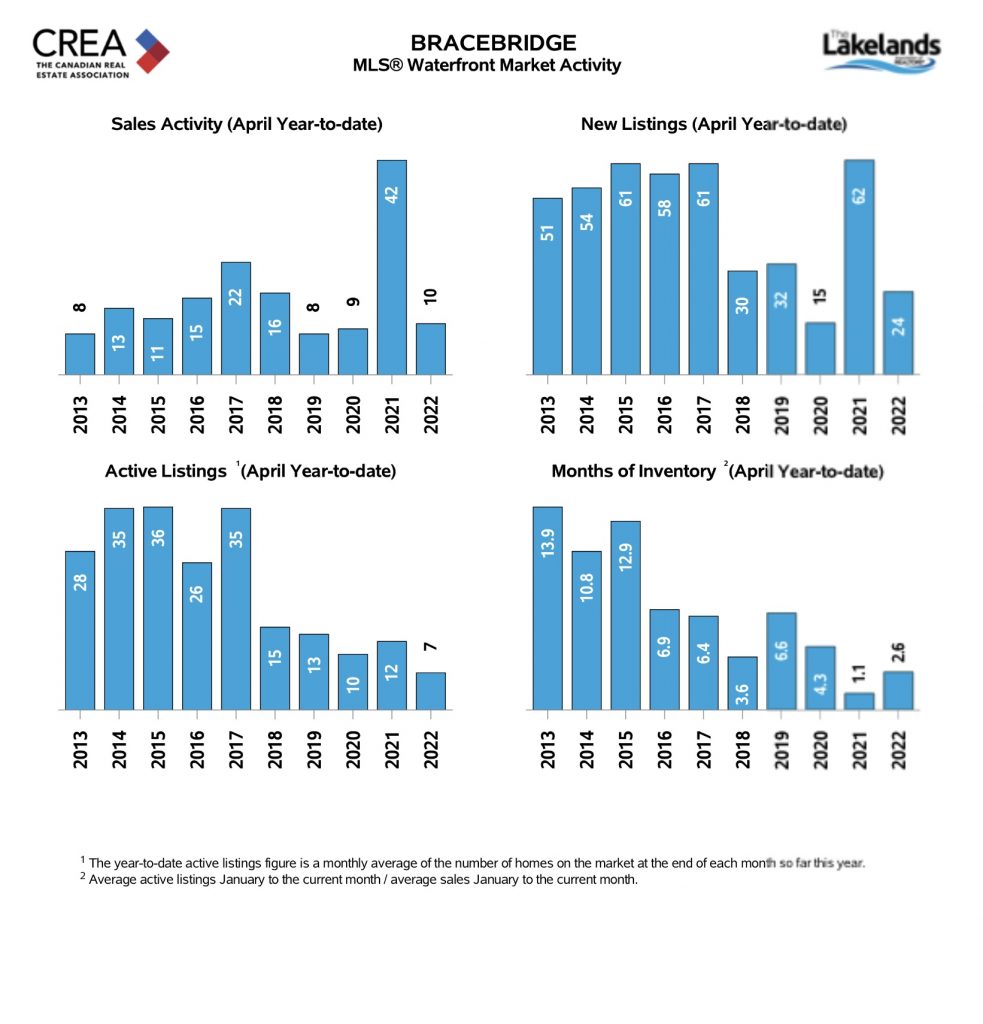

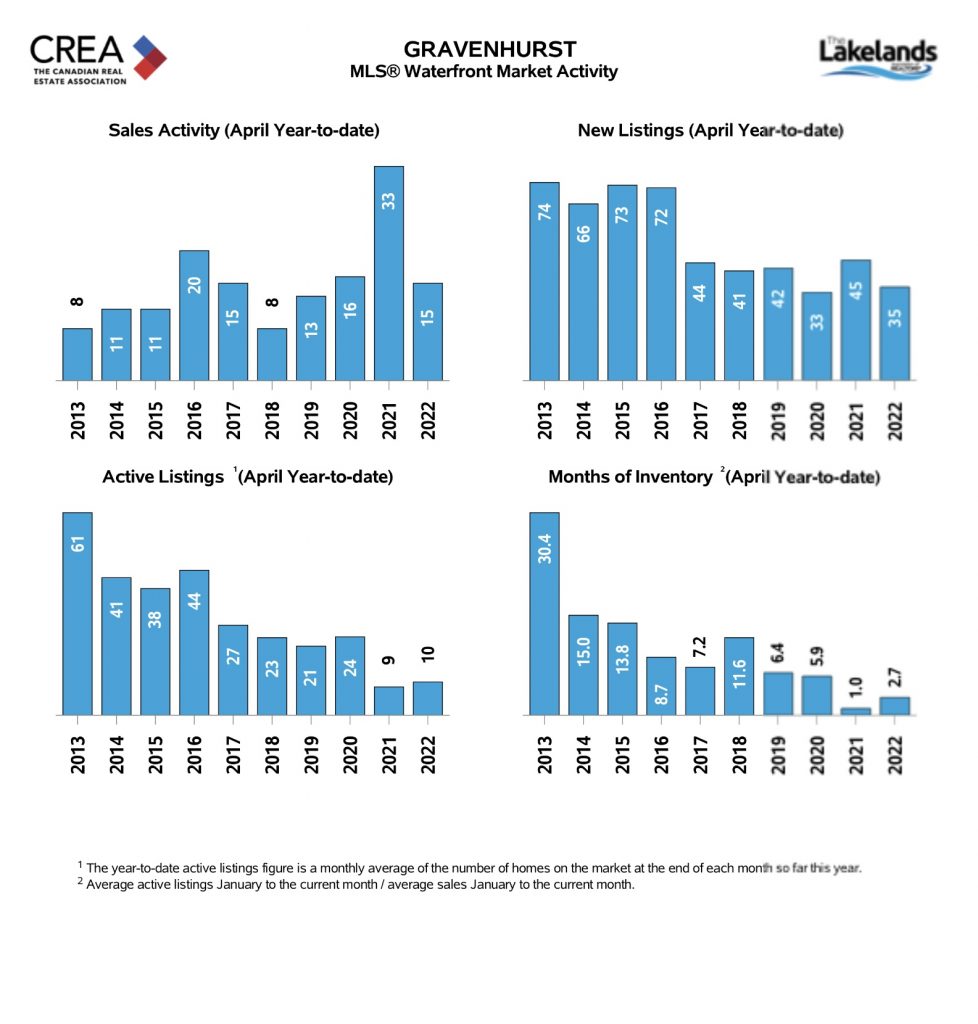

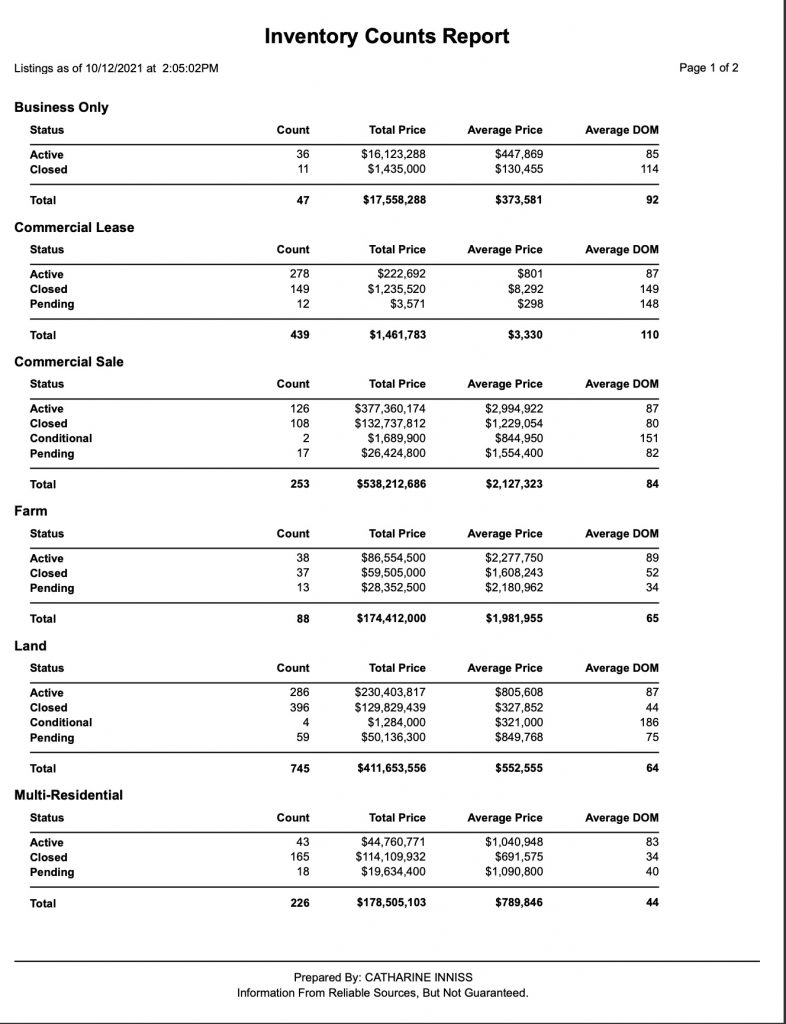

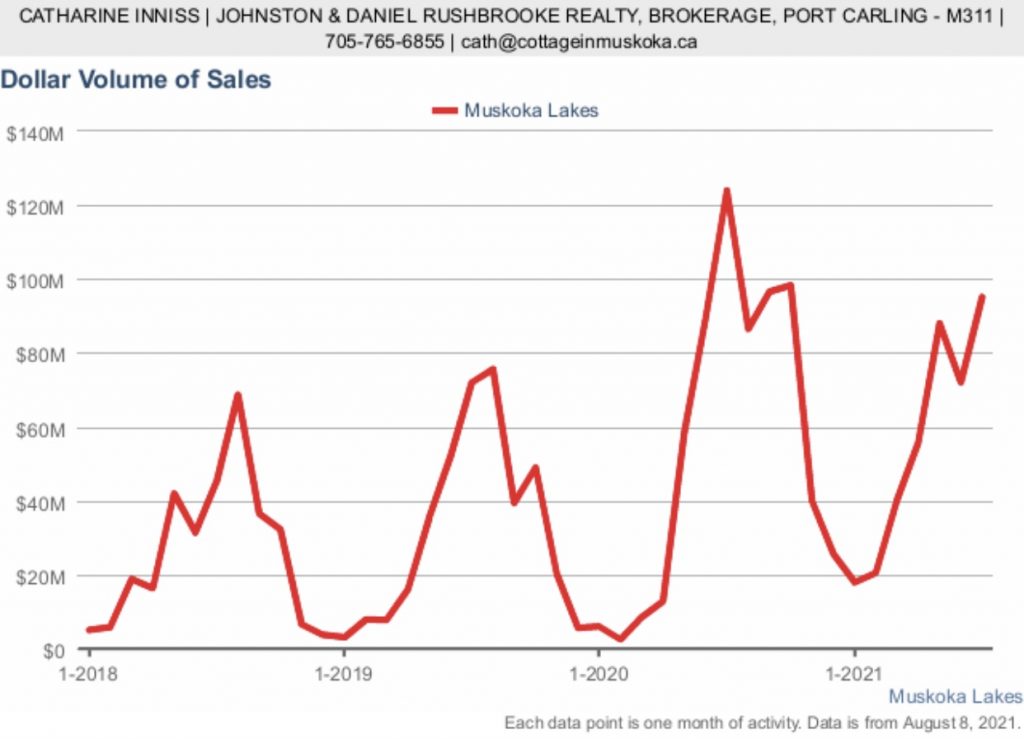

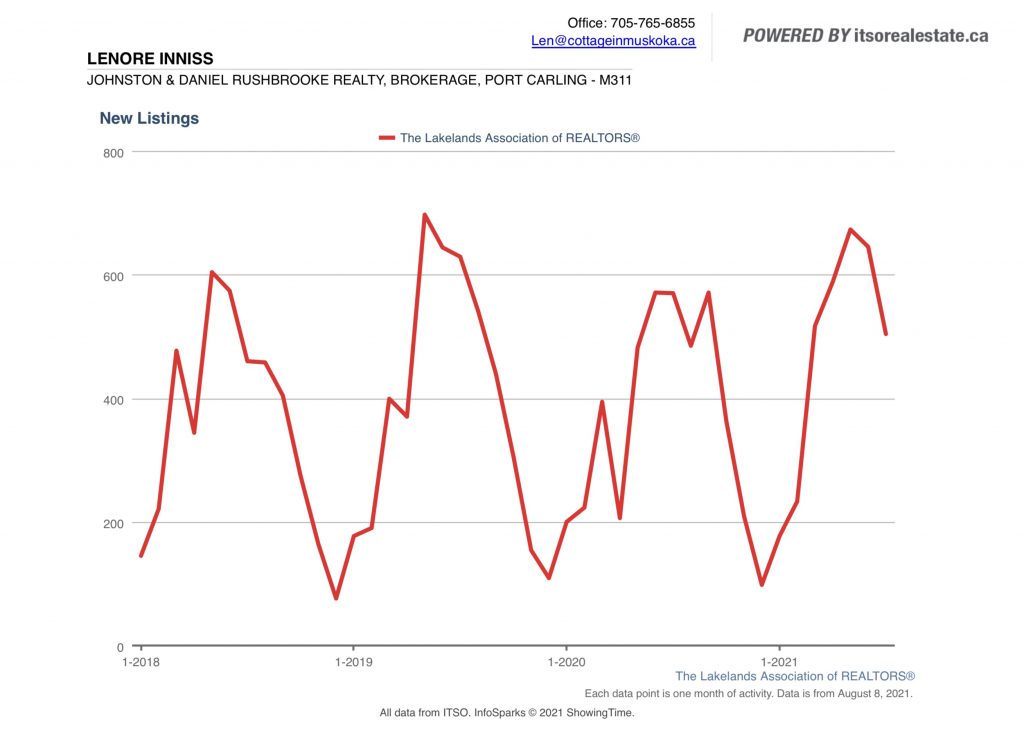

Inventory

Inventory grew to levels not seen since 2019 and tripled that of the historical lows from the last half of 2020 to the first quarter of 2022. With more choices for buyers, the multiple bidding phenomenon cooled substantially in 2023, curtailing the main inflationary element we saw during the pandemic. While the pandemic saw the a surge in investment cottage buyers, we did see the return of the more traditional cottage buyer this past year. They acted quickly and decisively when they came across the unique combination of features and price they sought. Unlike in 2008 and the early 1990s, buyers are still very much engaged and able.

resulting in an overheated market and unprecedented price increases. 2023 saw the return to a more normal

correlation between sales and inventory.

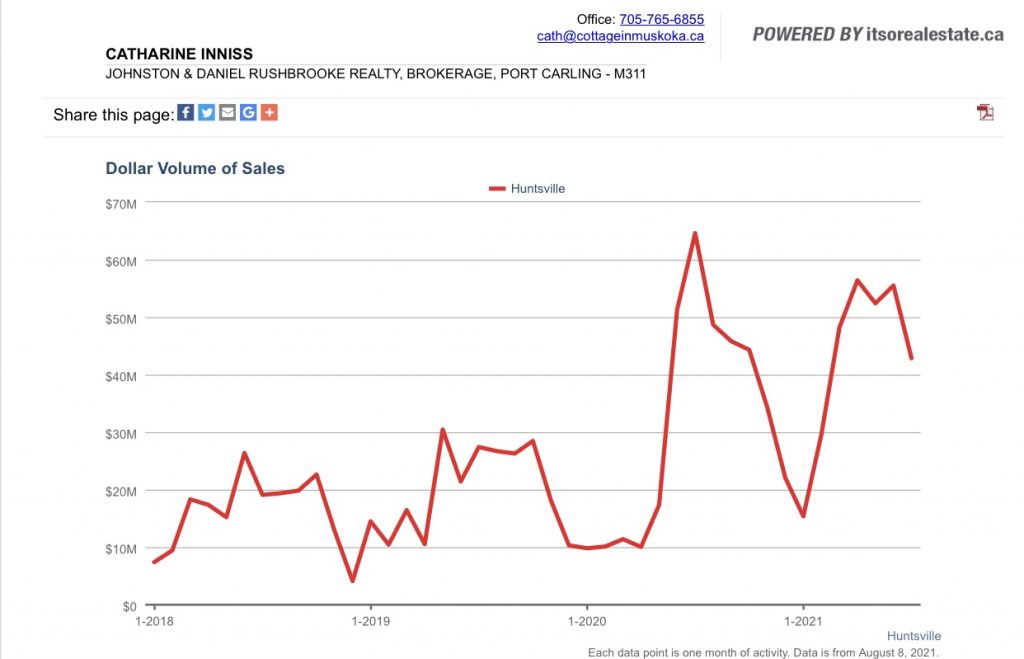

Annual Unit Sales – Over List vs Under List Price

infer that the majority of these sales were either in a multiple bid scenario or that a multiple bid was anticipated by a

determined buyer.

Post Pandemic Pricing Table – Muskoka Recreational

level cottages are now in the $700,000 plus range. On a percentage basis

the entry level saw the largest year over year increases during the pandemic.

If you have any questions or want more specific data about your Township, please email me at cath@cottageinmuskoka.ca!