We are starting to see the Muskoka real estate market shift. From the frantic 2021 cottage market season right up until recently, holding offers until a specific date has been a popular strategy for sellers to drive up competition for listings. Listings were seeing a large number of offers and disappearing from the market quickly. Now we’re seeing more of a mix – some listings are seeing multiple offers, and some are quietly removing their request for offers when the day comes and passes with nothing.

One factor in the shifting market we’re experiencing is the Bank of Canada raising policy interest rates by 0.5% in April, one of the major goals of which was to bring inflation levels back to their target 2% (vs. the 6.7% reported in March). This is the first time it has raised rates by more than 25 basis points in more than two decades. Higher interest rates mean higher borrowing costs, which lowers demand. We expect interest rates will continue to be increased until borrowing costs are back to pre-pandemic levels of 3%. The next announcement is on June 1, 2022.

The 2022 Federal Budget also puts a few factors into play that could effect Muskoka’s real estate market moving forward. It focused heavily on housing initiatives, including (among others):

- A foreign ban on buyers for two years

- An anti-flipping tax that removes the principal residence exemption for properties that were purchased and sold within the same 12-month period (with some exceptions). The proposed anti-flipping measure would apply to residential properties sold on or after January 1, 2023.

- Sales tax on all assignment sales. Starting May 7, 2022, anyone selling their agreement of purchase and sale to a new buyer will be subject to a tax of up to 26%

Does this mean the bottom will fall out and prices will go way down? Highly unlikely. Historically, we still have quite low inventory. It’s gone up from 2021, but properties are limited – especially waterfront. Plus, the already strong desirability of living in Muskoka has only increased after the pandemic. On top of that, there is still a large portion of the population approaching retirement age, who are looking to relocate to somewhere like Muskoka for their golden years.

If you’re a buyer, it’s time to shake off the fatigue of last season and get back to your cottage search – with less competition.

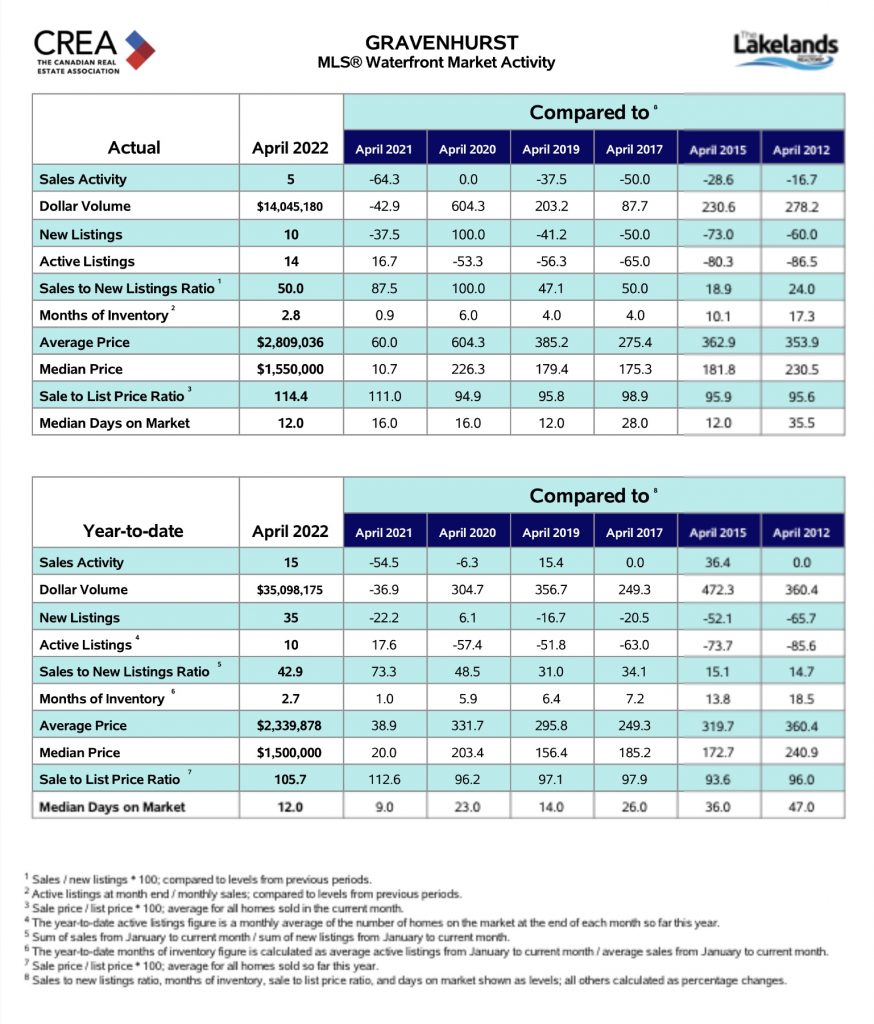

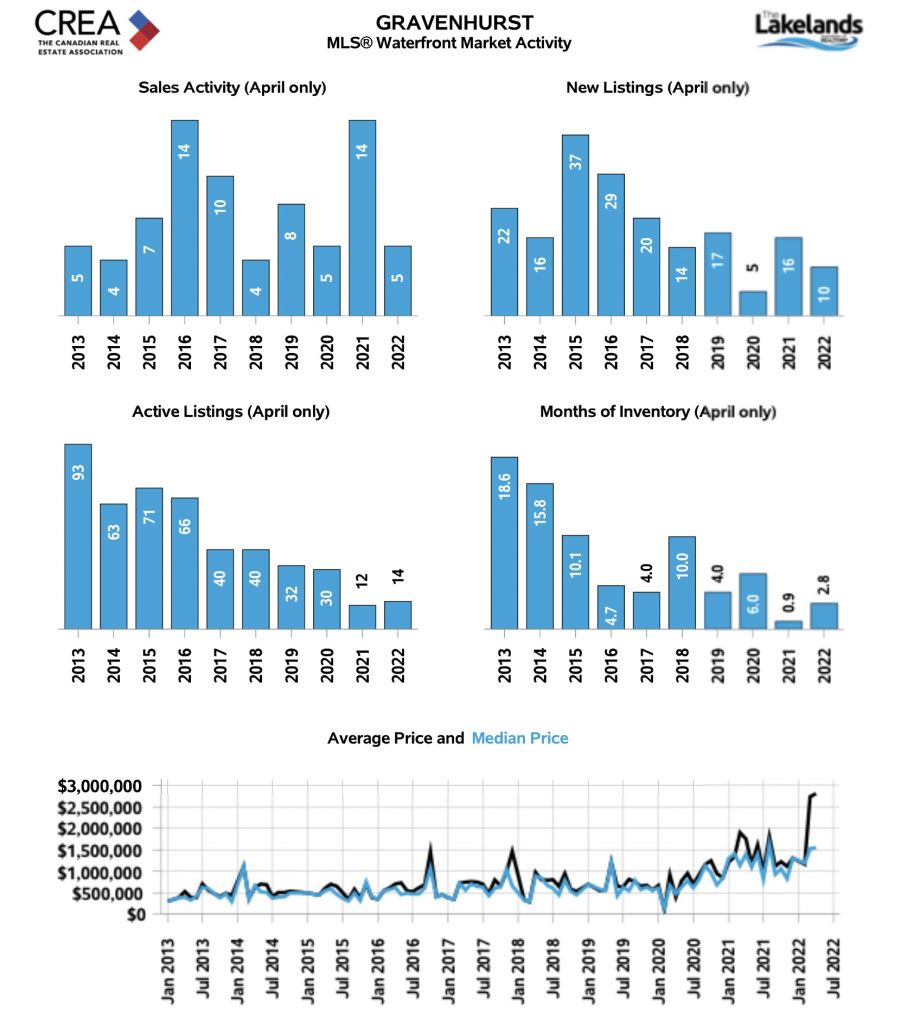

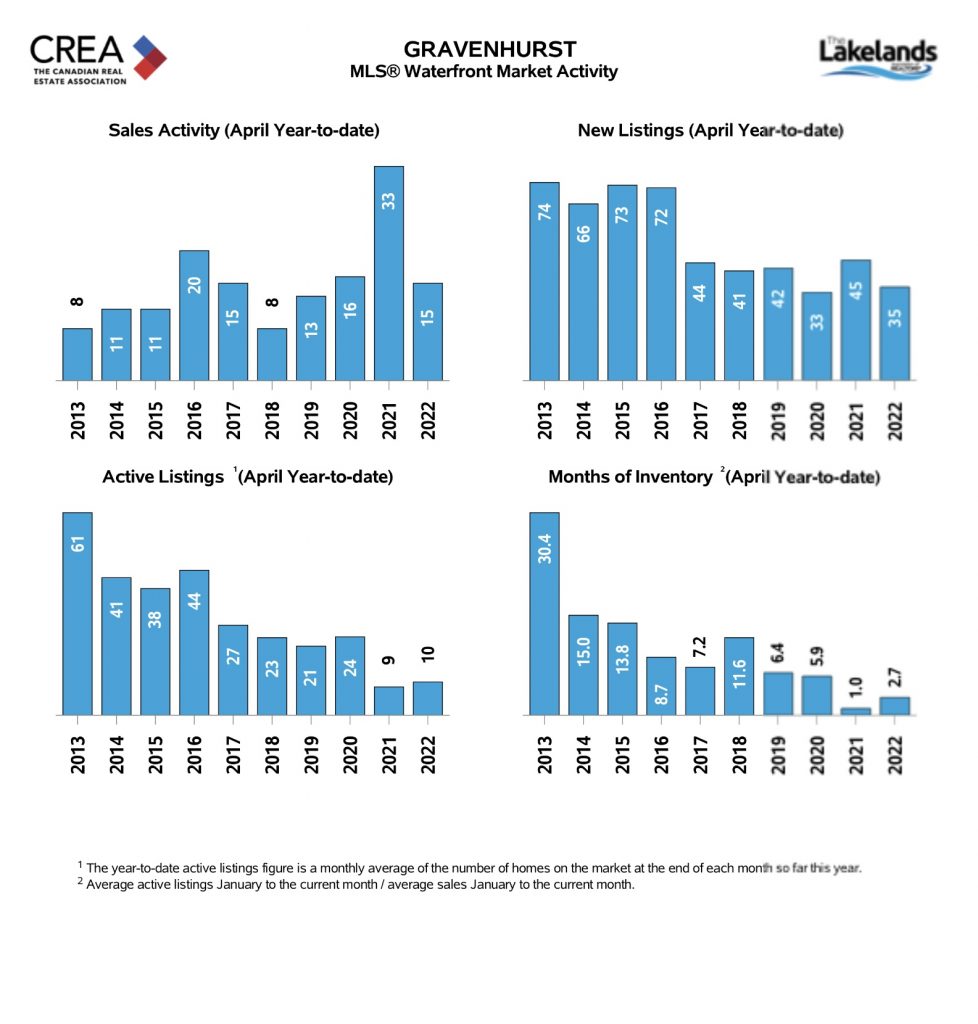

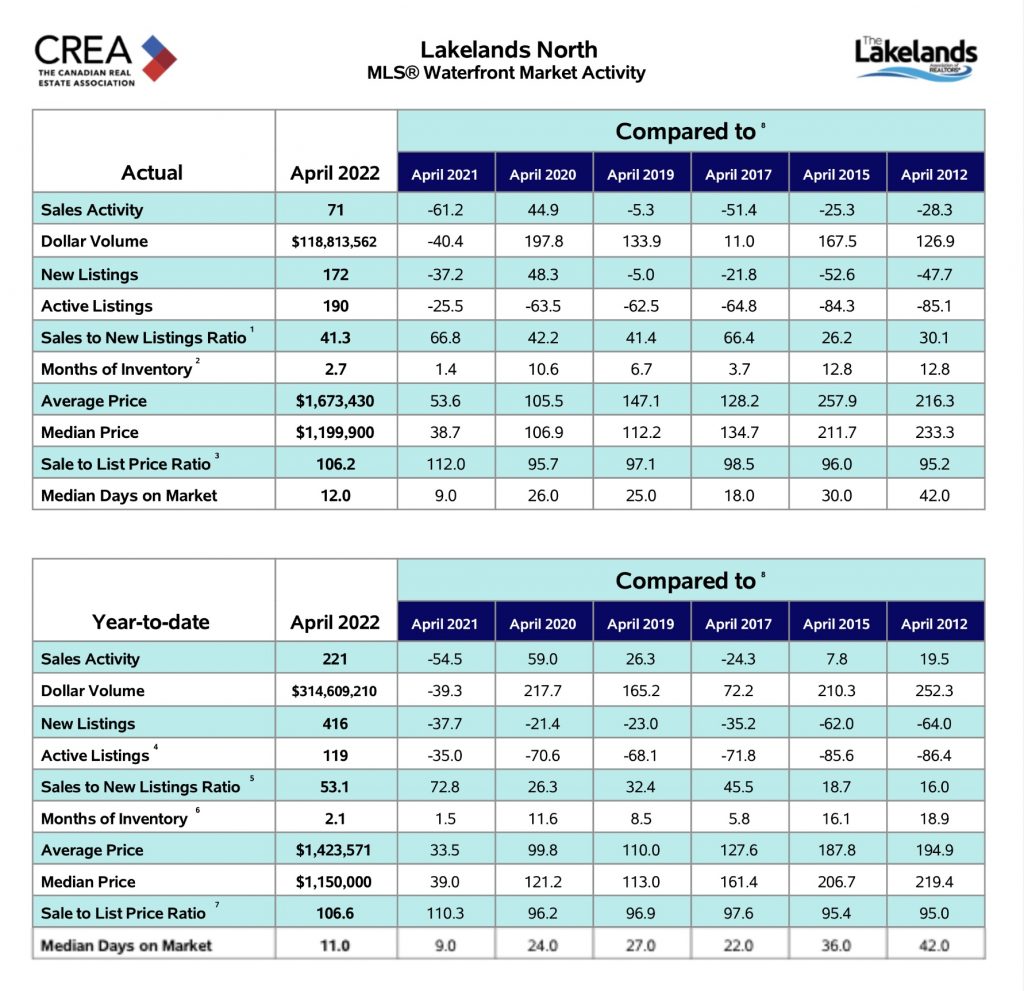

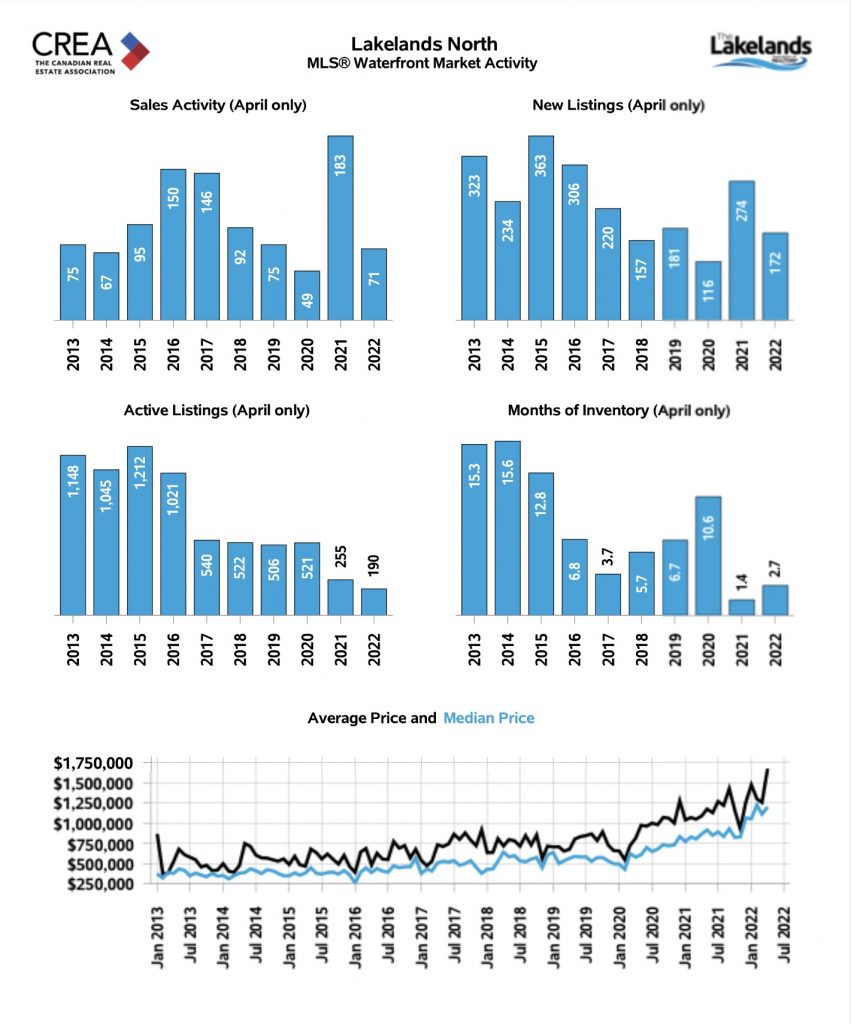

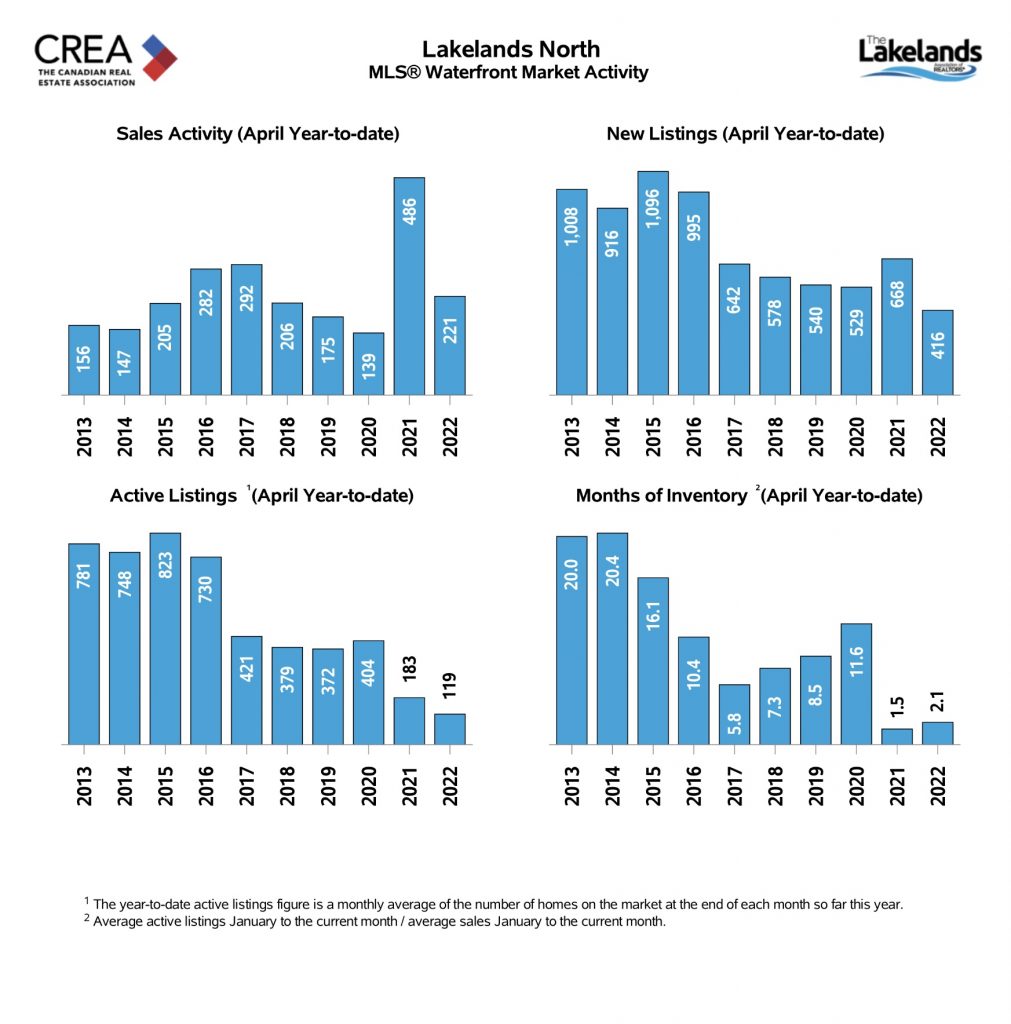

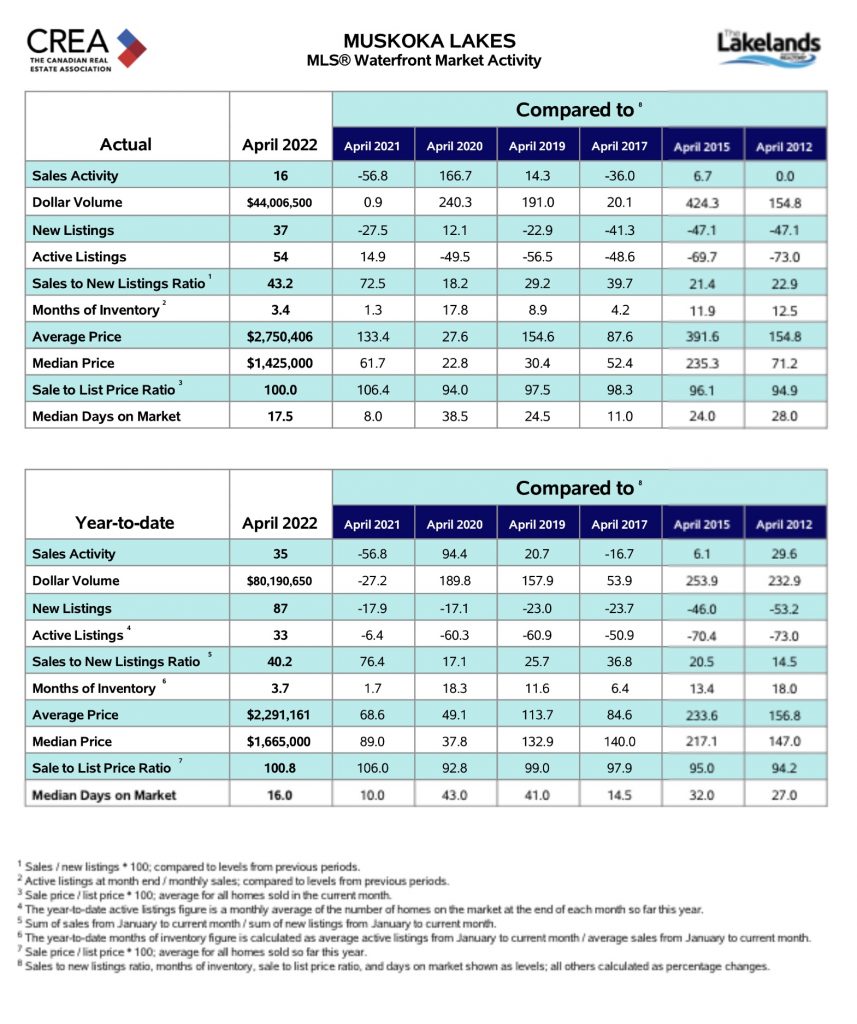

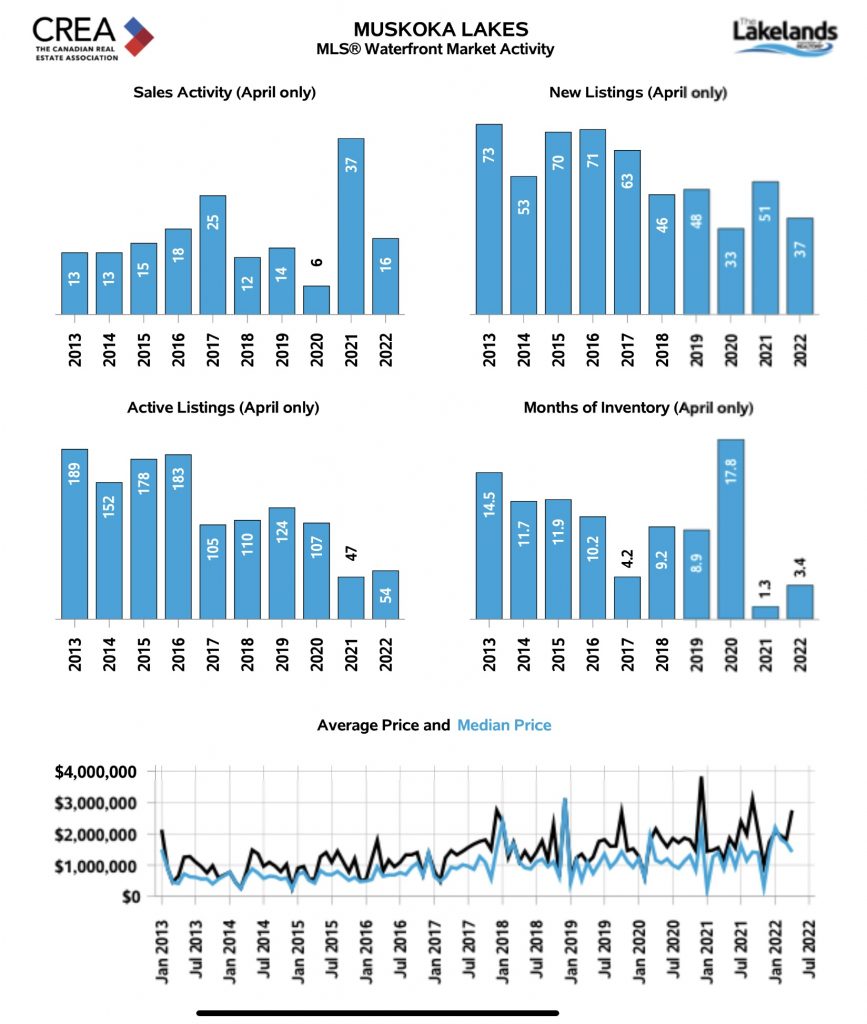

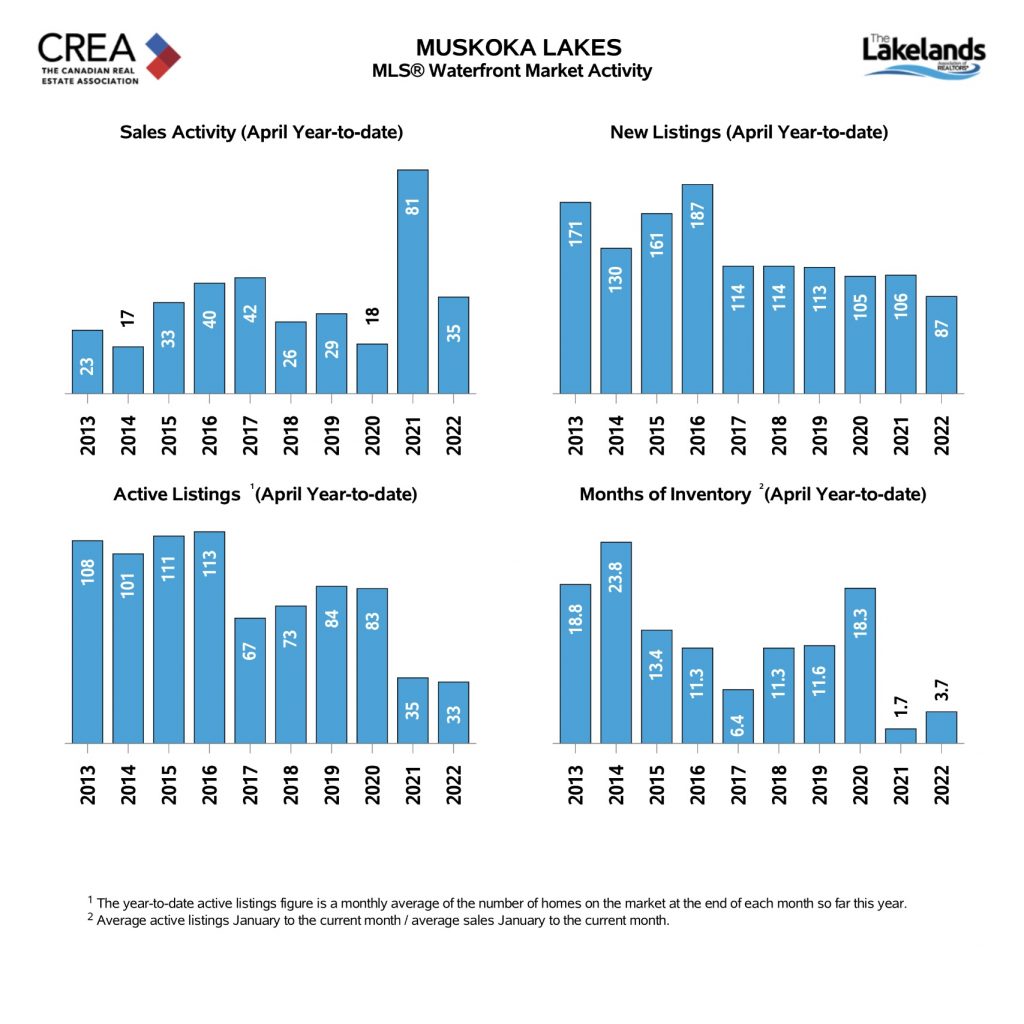

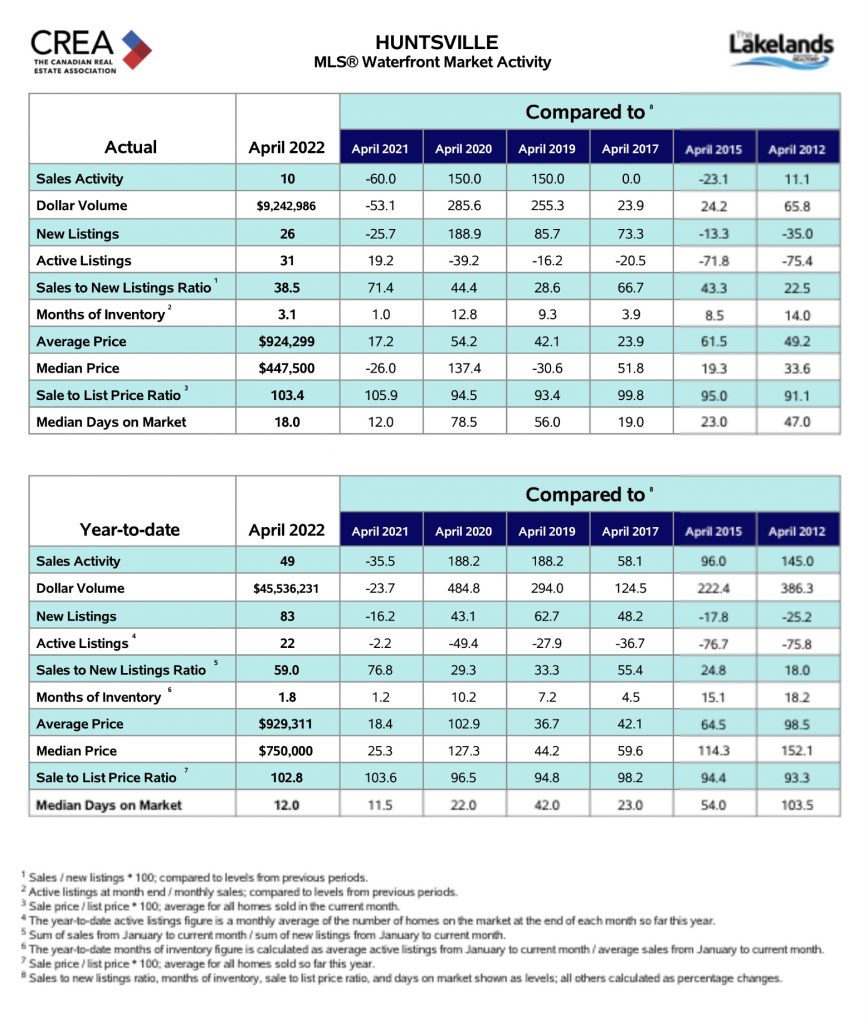

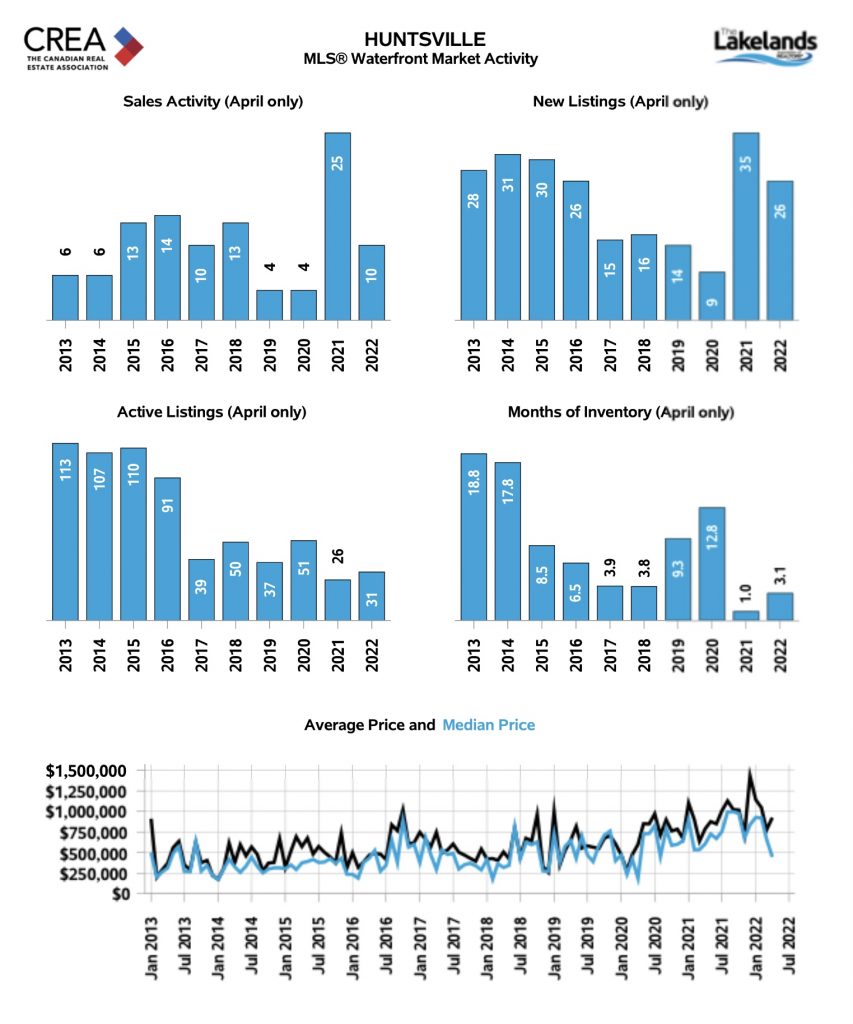

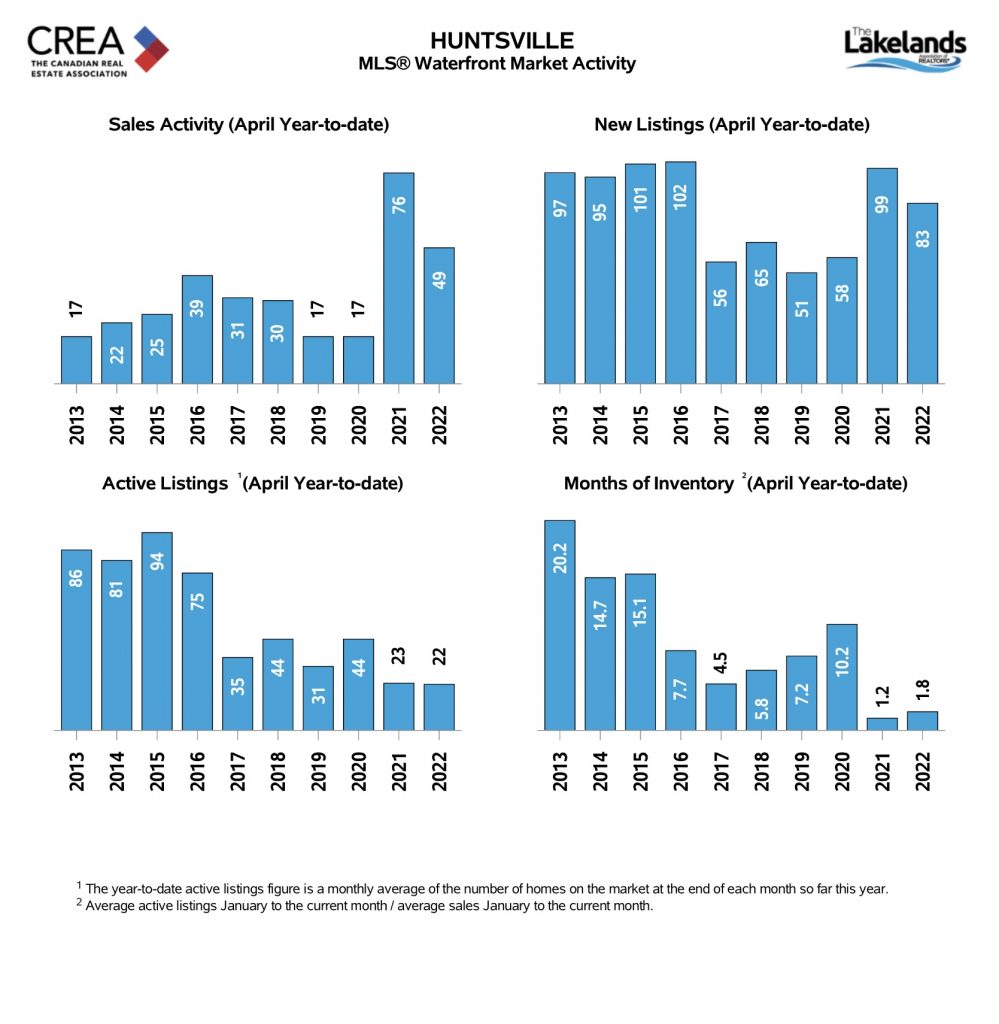

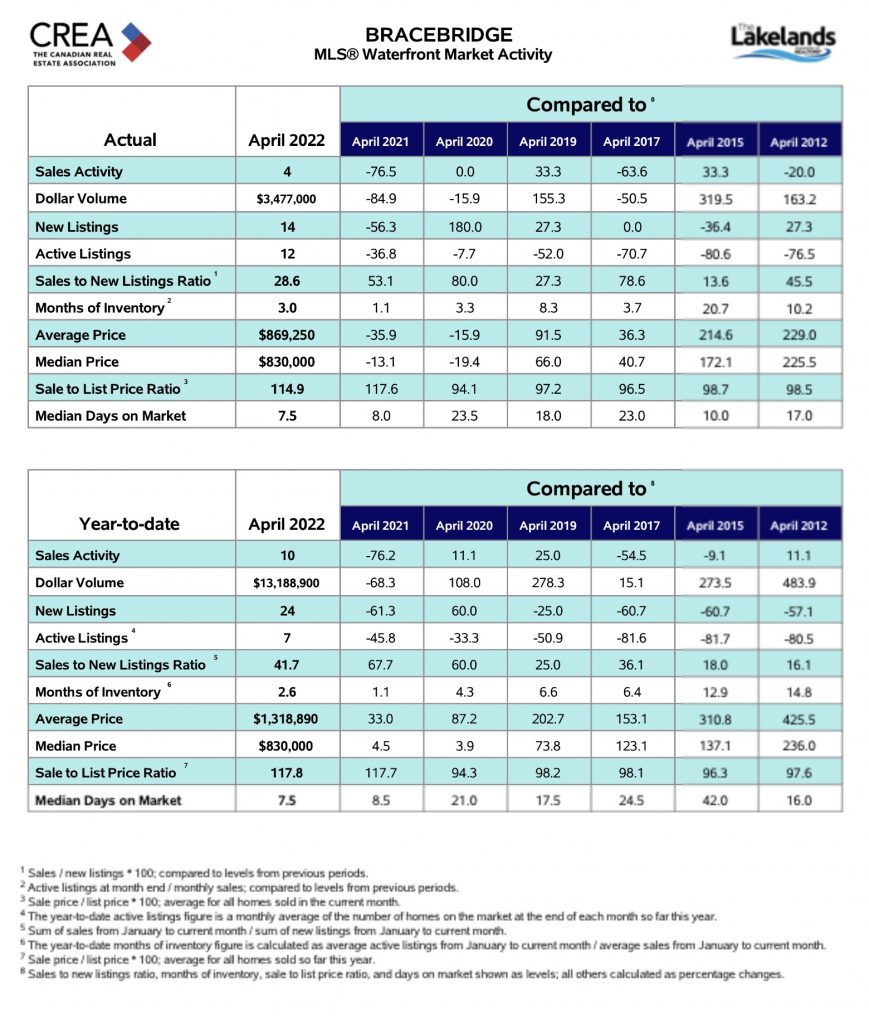

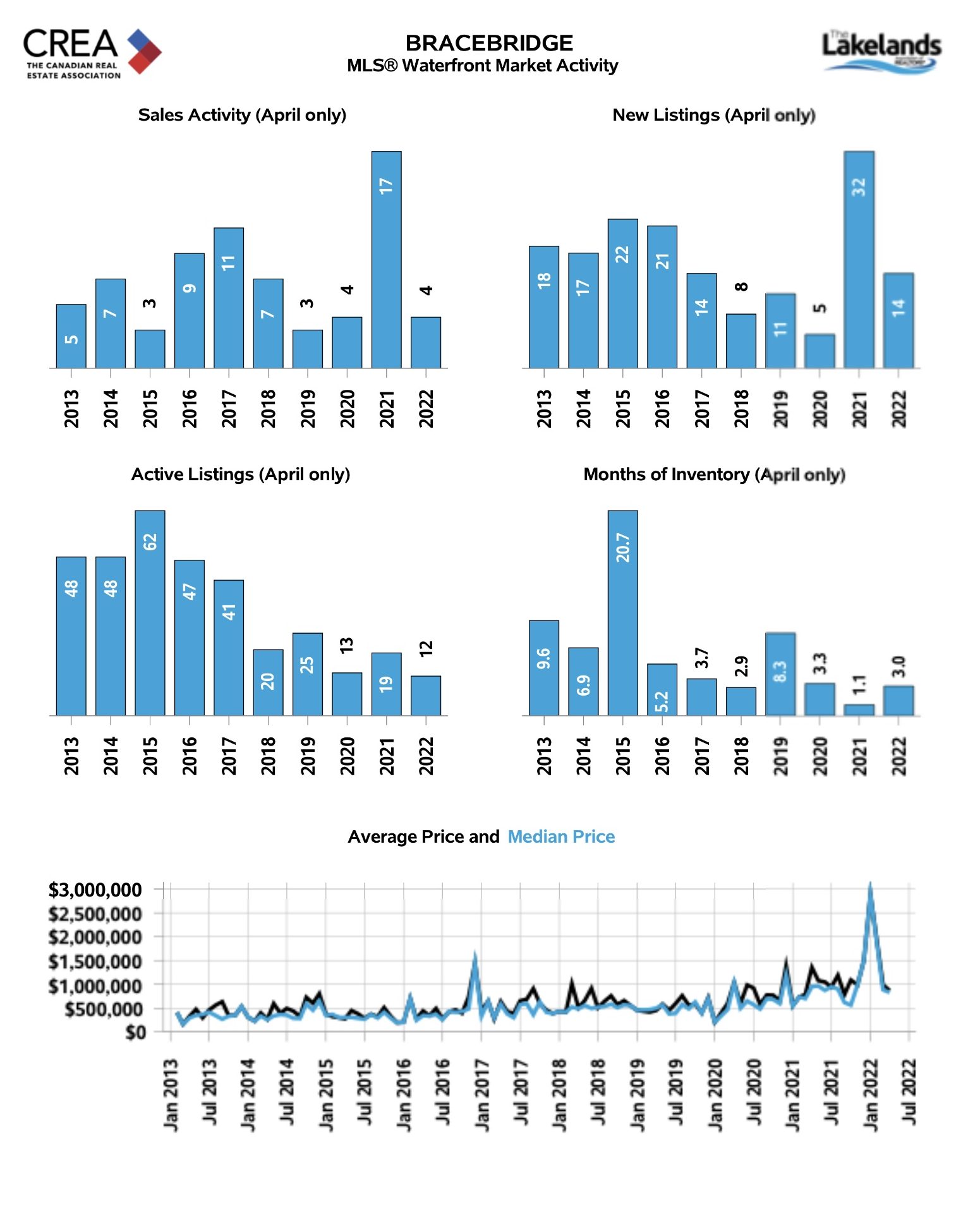

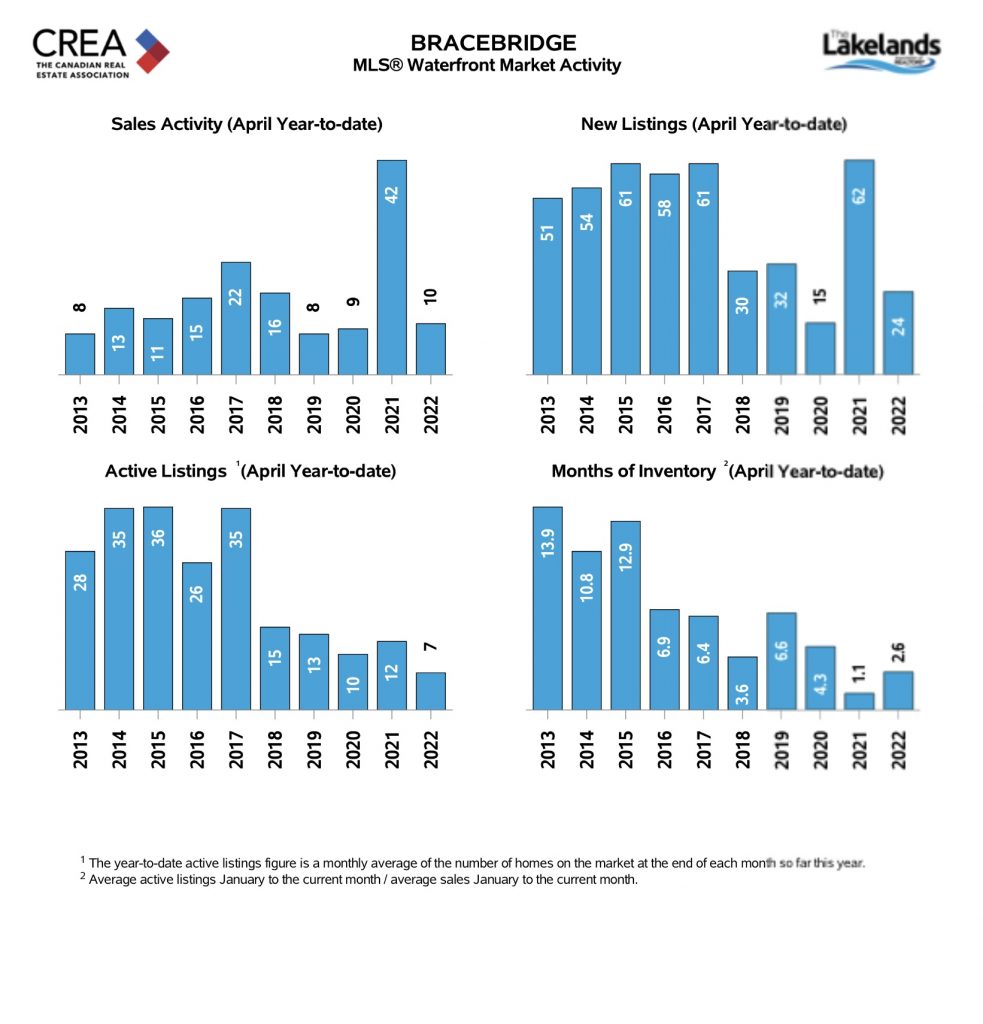

I have posted the relevant stats for overall waterfront market activity and waterfront market activity by location below, for our more analytically minded friends.

If you’re looking for non-waterfront stats or anything else that I haven’t included please email me at len@cottageinmuskoka.ca. I’d be happy to send it to you!

Overall MLS Waterfront Market Activity

Muskoka Waterfront Market Activity by Location

Muskoka Lakes

Huntsville

Bracebridge

Gravenhurst