Muskoka is a unique, highly sought after and magical place. There are many different kinds of buyers and sellers here. Some merely want a little piece of paradise to escape and camp out in the woods. Others want a mansion on one of the ‘Big Three’, or one of the 2200+ lakes in the district.

And the rest of us are somewhere in between. Waterfront or not, permanent residence or not, we all appreciate being surrounded by water and granite and pine and to do a little swimming, boating, hiking and star gazing.

The privilege can be costly, especially since the pandemic.

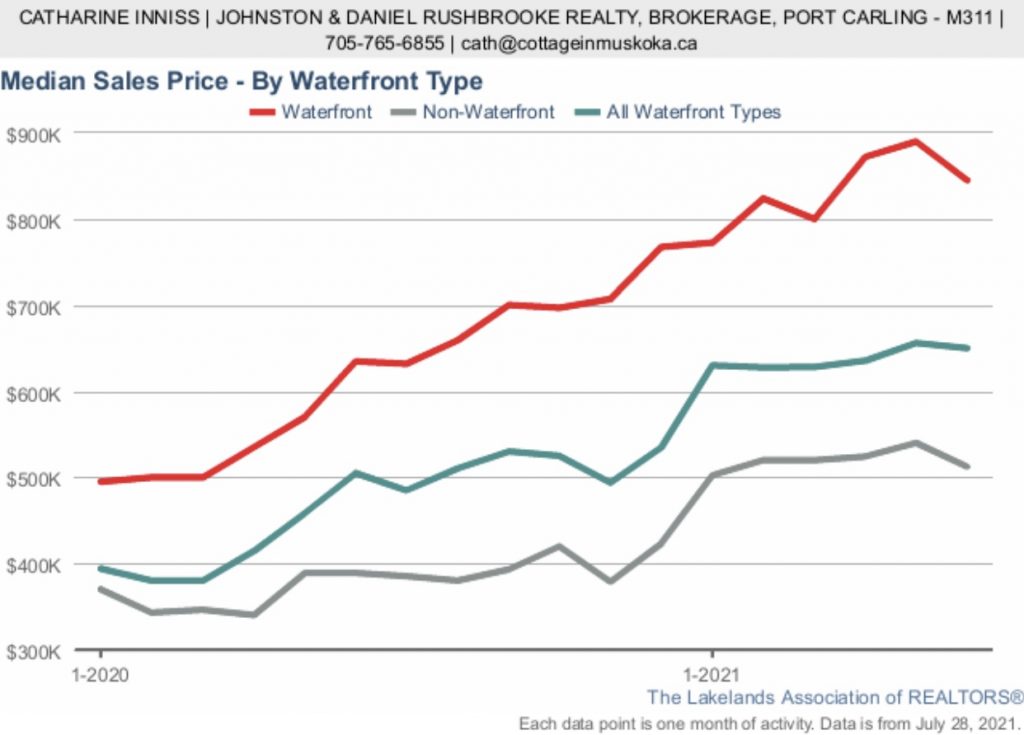

Overall prices are up year over year, and have gone up a median value of about $350,000 for waterfront properties since the beginning of 2020.

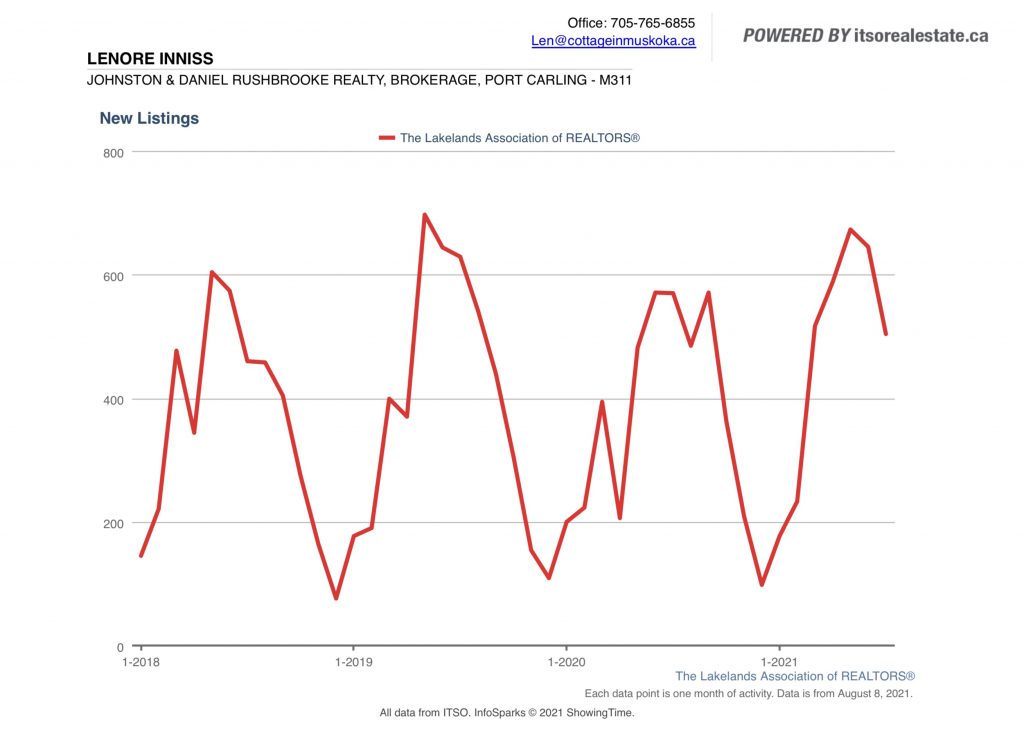

There were 499 new listings in July and 377 sales. The average DOM (days on market from listing to sale) is 14. Last year the average DOM for July was 23. July 2019 24. July 2018 was 30. We are seeing a trend here.

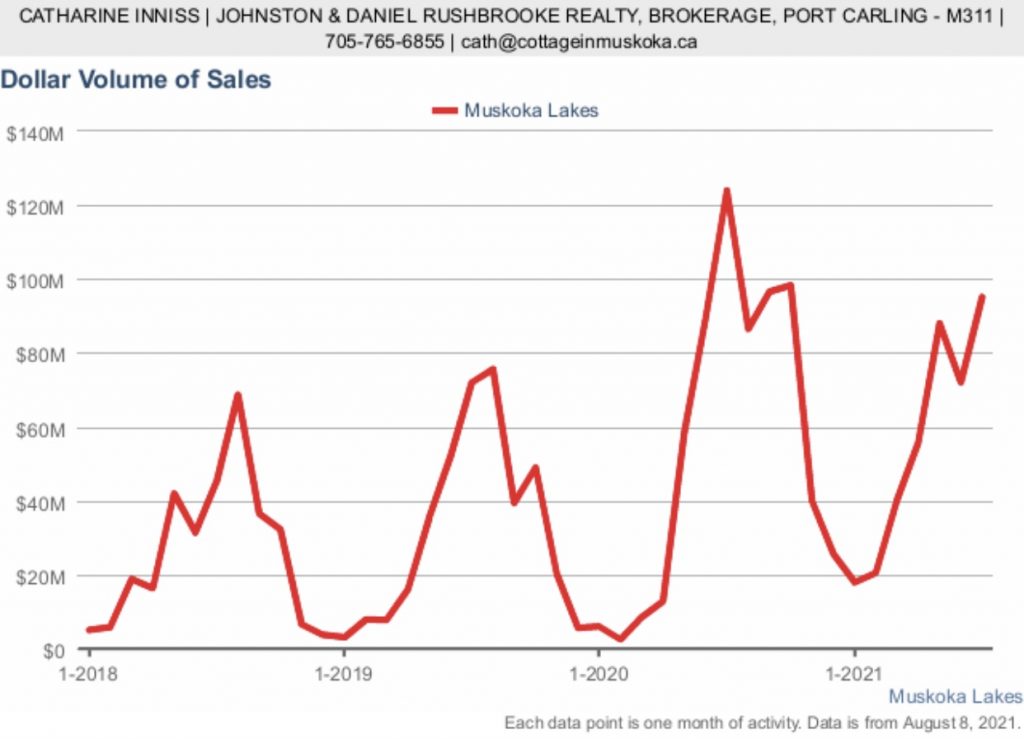

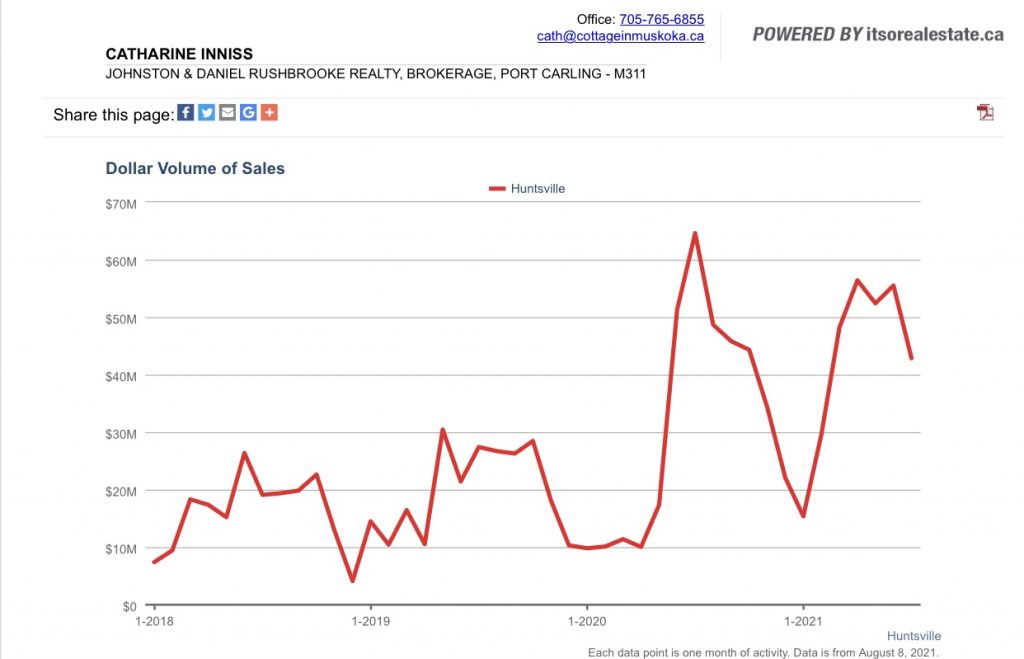

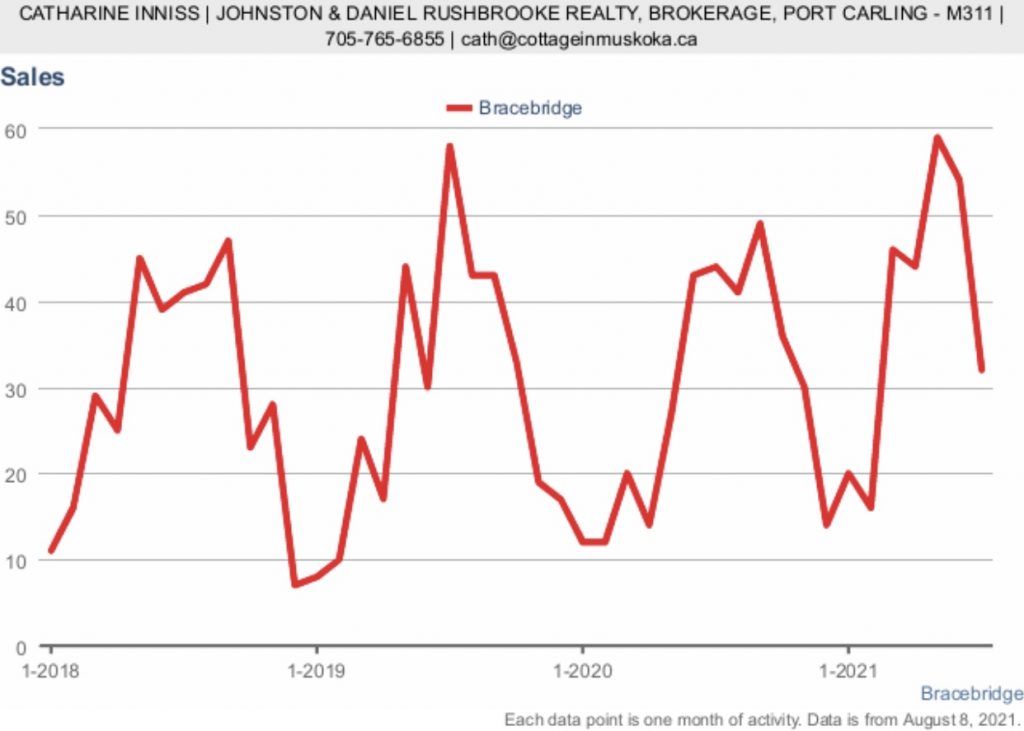

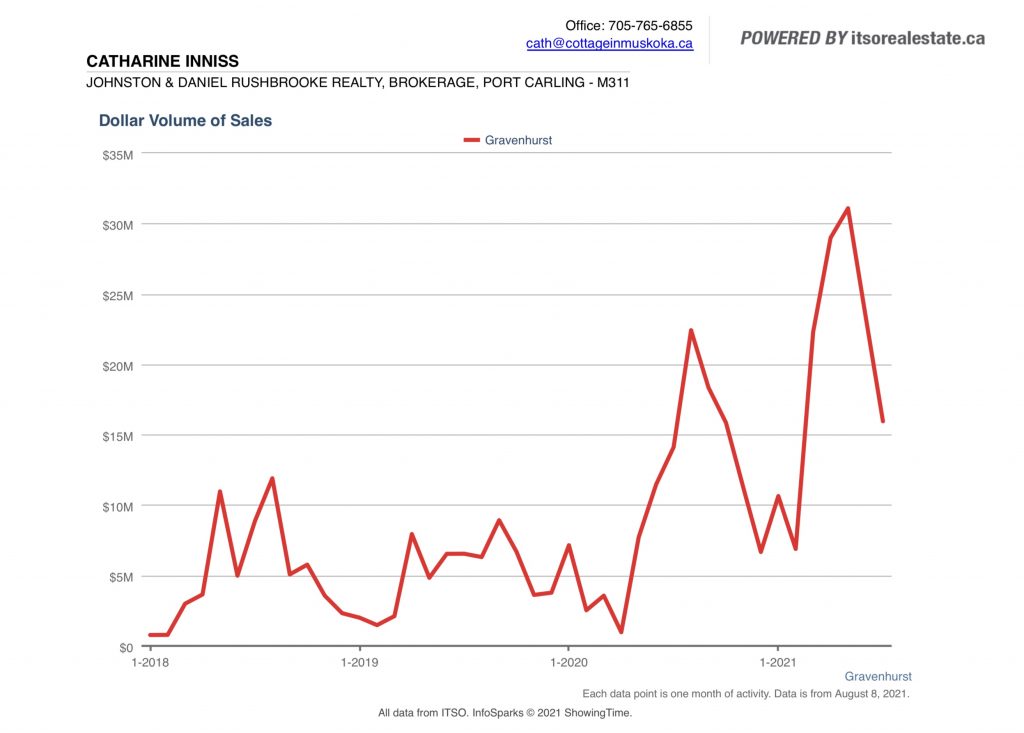

In terms of dollar volume:

There were 44 sales in Muskoka Lakes. 37 were waterfront and 7 non waterfront. The total dollar volume was $95,220,518.

There were 57 sales in Huntsville. 19 were waterfront and 38 non waterfront. The total dollar volume was $41,870,436.

There were 31 sales in Bracebridge. 10 were waterfront and 21 non waterfront. The total dollar volume was $21,252,027.00.

There were 29 sales in Gravenhurst. 7 were waterfront and 22 non waterfront. The total dollar volume was $19,314,650.00.

There is only a 2.5 month supply of residential properties available currently. The definition of supply refers to the number of months it would take for the current inventory of homes or cottages on the market to sell. Historically, six months of supply is associated with a balanced market between buyers and sellers and a lower level of months’ supply is considered a seller’s market and therefore they can expect to sell faster at a better price. In any market a substantially overpriced property will linger. The key to proper pricing is listing at a reasonable price and encouraging competition. Buyers will only compete when a property is appealing both in terms of features and price.

The trend has been toward less inventory for the last few years – with the exception of a small spike this year due to sellers wanting to cash in on this crazy market.

We do not see the ‘bubble’ bursting. We do not think that there is a bubble. It is a case of supply and demand. And those demanding having a lot of liquidity right now, due to many months of not spending in restaurants, on travel, services like spas, house cleaners, clothing, commuting etc. Interest rates remain low. Cottage buyers for the most part have not been negatively impacted financially by the pandemic.

Inventory has been relatively low for the past several years and we can see why when we look at the relatively low total number of cottages versus the potential buying pool. The Golden Horseshoe has a population of over 7.8 million. Say you considered just one percent of that number – that is 78,000 people in the market for a cottage. And that doesn’t count international buyers or buyers in the rest of Canada.

Some buyers are interested in purchasing to rent their places out. There is a lot of money to be made, but buyers should beware. For those who are perking up their ears, these purchases tighten off an already limited supply. Carefully vet your renters. Property damage is a real risk, as is annoying the neighbours with loud and boisterous behaviour. Enough of that, and the townships may decide to ban rentals.